Best Practice Guidelines: Healthcare Practice Management & POPIA Compliance Framework

Best Practice Guidelines: Healthcare Practice Management

&

POPIA Compliance Framework

Copyright © 2021 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

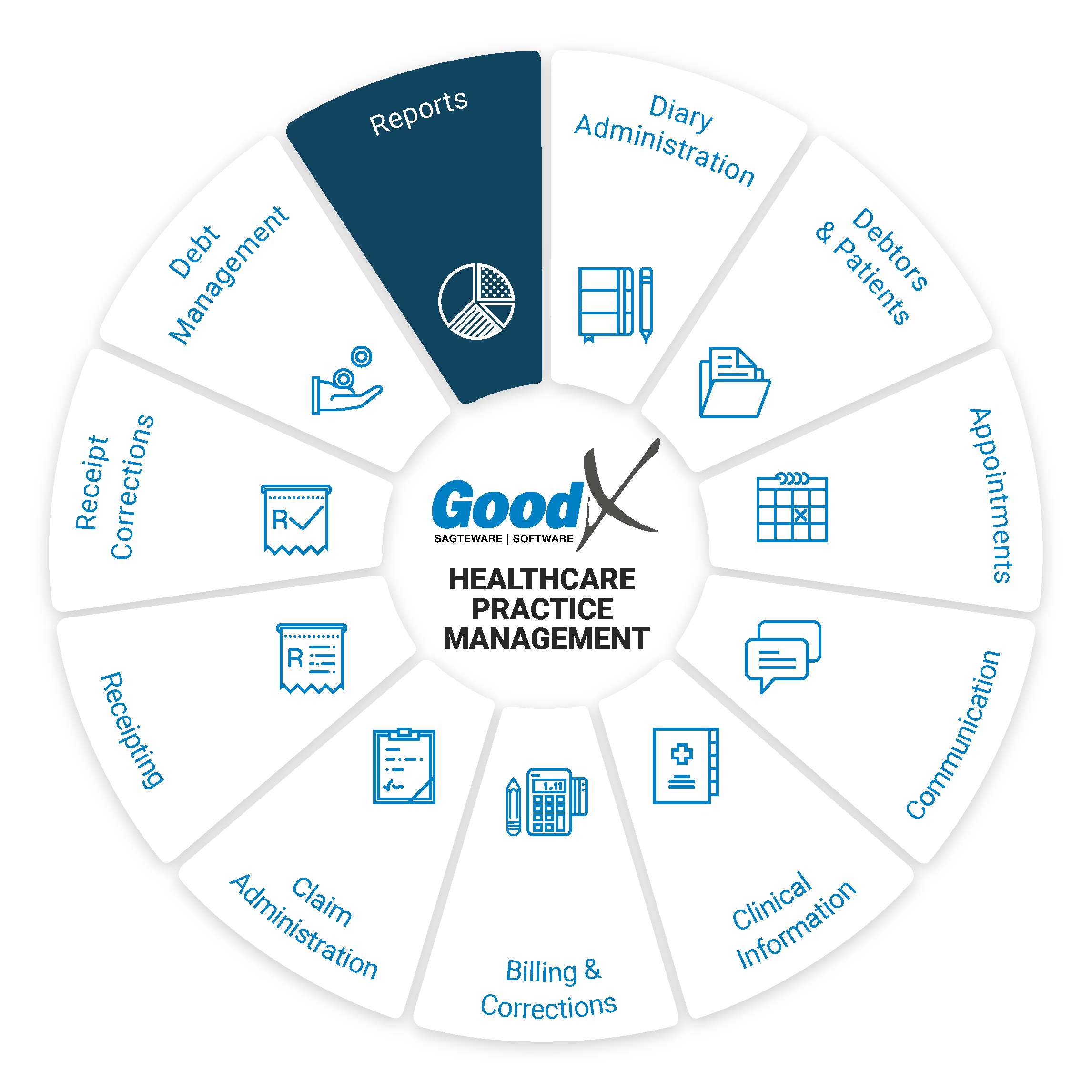

15. Reports: Roles, Purpose, Dates & Terminology

Responsible Roles

|

Management Role:

|

|---|---|

|

|

Operational Role:

|

|

|

Operational Role:

|

| Action maps: Compliance continuity stage:

|

Purpose of Reports

Reports communicate information compiled as a result of the analysis of data captured in the software. Reports convey information to assist Practitioners and business owners in business decision-making and planning and comply with laws.

Dates in GoodX

To be able to draw the reports correctly and consistently, the user must take note of the following different dates used in drawing the reports:Transaction date: the service date on which the consultation or treatment was performed.

Capture date: the date the information was captured on the software system.

Period: the financial period in which a transaction is captured, e.g. 1 March to 31 March, is period one for practices whose financial year is from 1 March to 28 February.

Take note:

- It is imperative to always work with one type of date. Depending on your type of practice, your reports should be drawn per period.

- If reports are drawn with different data types, the reports will not balance with each other.

- If reports have been drawn, e.g. for March according to the capture date or period, but corrections are done in April for March, and the same reports are drawn in April based on the capture date or period, the reports will differ. It is therefore imperative that if transactions are reversed and redone, those updated reports are drawn for the month.

Reports terminology

Filters

Information can be excluded so that only selective information can be viewed in the report. There are three types of filters in GoodX:

- The single selection filter per column by a dropdown menu;

- The custom filter provides two options by which to filter information; and

- The advanced filter provides unlimited filtering options.

Sorting

Information can be sorted alphabetically or numerically.

Grouping

Information can be grouped by transaction type, practitioners, service centres, dates, amounts, billing codes, medical aids, ICD10 codes, referring and treating doctors and price lists.

Settings

Reports can be customised by choosing items in the settings of the report. The user manuals describe the items so senior reporting personnel can set up their own reports. If you set up your own reports, you will know what information the reports generate.

Parameters

Parameters are the filters used to limit the scope of a report. Parameters used in the GoodX reports are:

- All amounts

- < 0

- > 0

- = 0

- Not equal to zero

If, for example, an age analysis is generated with a scope of amounts larger than zero on the debtor accounts, the report will not show the credits on the debtors' accounts.

The following Reports should be drawn regularly and will be discussed in the sub-chapters:

- Debtor Transaction Drilldown (Daybook)

- Age Analysis

- Assistant Audit Report

- Invoices Outstanding

- Debtor Statistics Report

- Turnover Report

- Turnover Report (Codes Billed)

- Practice Overview

- Doctor Overview

- Booking Status Report

- Booking Type Report

Web App Reports

It is vital for any Medical Practice that the Practice Manager ensures that the Critical Business processes are completed. This will reduce the risk of all kinds of losses, e.g. Data loss and Financial losses.

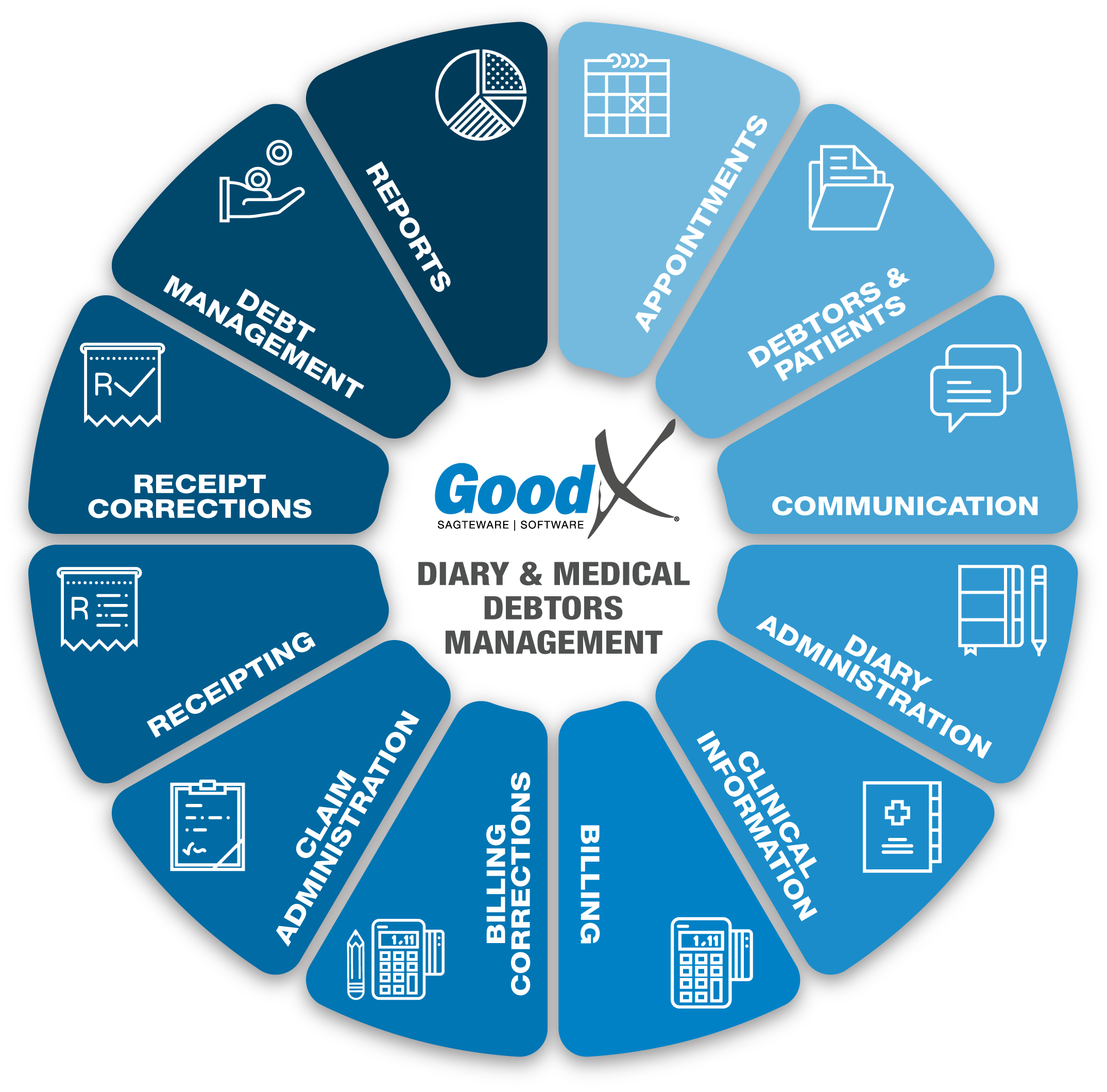

The following diagram gives an overview of the Internal Controls that need to be performed regularly. The Controls are performed by:

- Generating the relevant Reports available on the GoodX Software System;

- Analysing & Interpreting the information in the Reports; and

- Responding to the information by making corrections to the system OR implementing Management decisions based on the information to make the Practice more profitable.

In the Web App, the following reports can be accessed:

All reports can be exported to excel. The reports will show graphs, and the detail can also be viewed.