Best Practice Guidelines: Healthcare Practice Management & POPIA Compliance Framework

Best Practice Guidelines: Healthcare Practice Management

&

POPIA Compliance Framework

Copyright © 2021 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

10. Billing Corrections: Roles & Purpose

Responsible Roles

|

Management Role:

|

|---|---|

|

|

Operational Role:

|

|

Operational Role:

|

|

Operational Role:

|

|

|

Operational Role:

|

| |

Action maps: Compliance continuity:

|

Purpose of Billing Corrections

Purpose of Billing Corrections

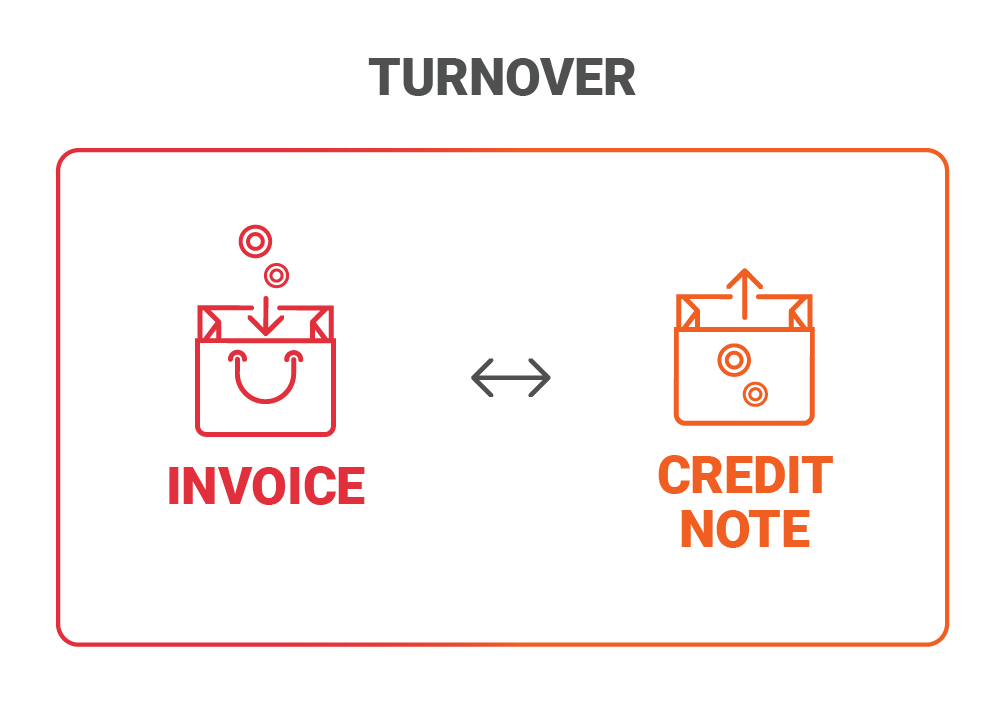

All corrections on invoices MUST be done with Credit Notes so that the turnover is amended. Redo Transactions will always create a Credit Note automatically before the Invoice can be amended and posted again.

Billing Corrections need to be done on invoices/billing that was done incorrectly. The corrections will assist in correcting the Reports, Turnover, Ledger Accounts and Debtor Account. All Financial reports will show the corrections, and a correction report should be kept for the Auditors every year.

Ensure that the correct personnel have access and that the personnel responsible for the correction understand the impact of each correction type on the reports.

JOURNALS SHOULD NOT BE USED TO CORRECT ERRONEOUS INVOICES - your reporting will be incorrect as journals post to expense ledger accounts and won’t correct your turnover or cash flow.

Journals are ONLY used for the following purposes: