Best Practice Guidelines: Healthcare Practice Management & POPIA Compliance Framework

Best Practice Guidelines: Healthcare Practice Management

&

POPIA Compliance Framework

Copyright © 2021 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

14. Debt Management: Roles, Purpose & Summary of Phases

14.2. Phase 2: Process Audit

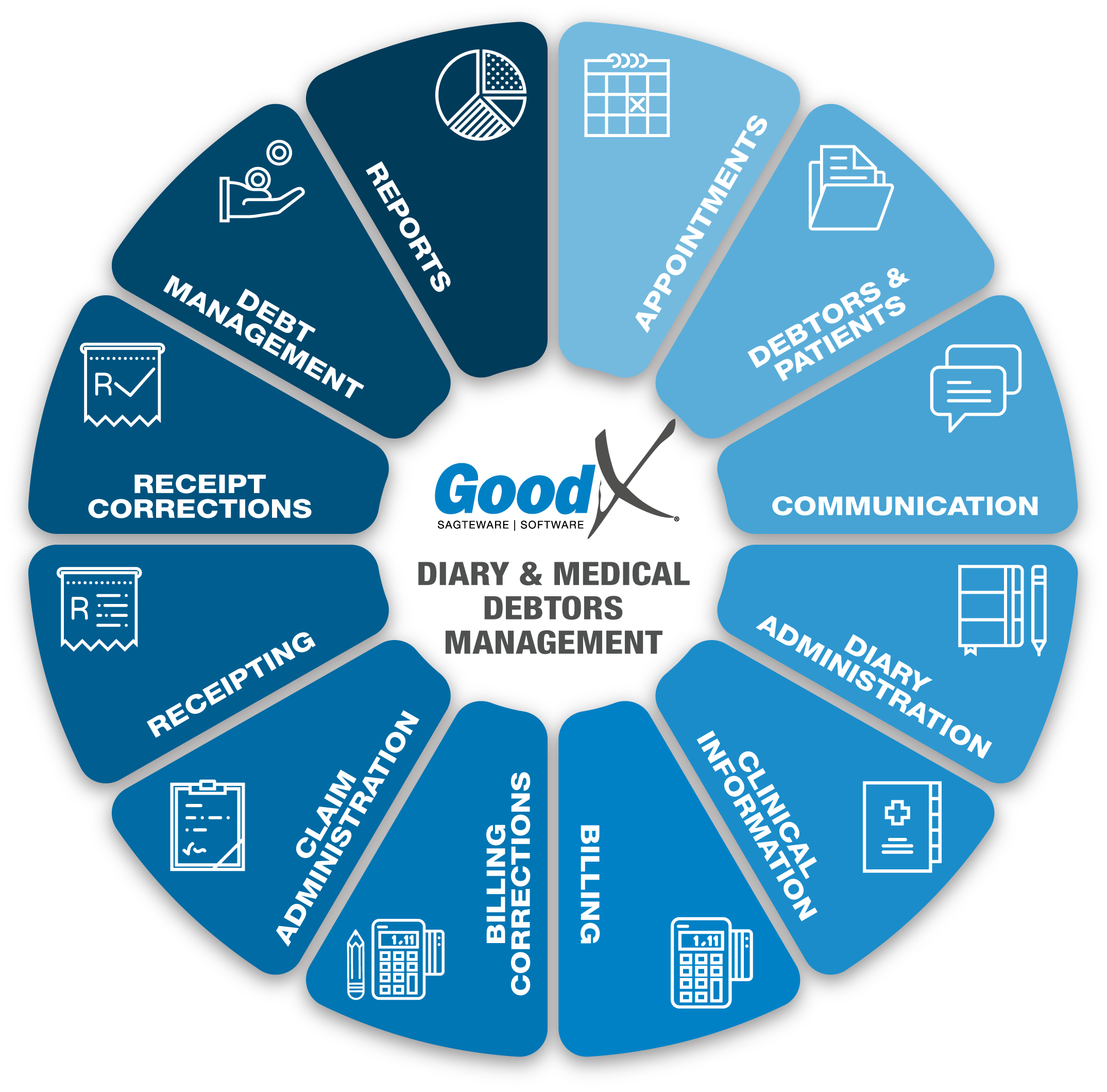

Users process transactions during the following critical business processes as illustrated in the Diary and Medical Debtors diagram:

- Billing

- Billing Corrections

- Claim Administration

- Receipting

- Receipt Corrections

The Process Audit Phase is where the Credit Controller checks that all transactions have been correctly captured in the software during these critical business processes. This step is vital to ensure that no paid accounts are collected in error and no unpaid accounts are missed. If all transactions were correctly captured, the outstanding amounts on the Debtors account will be correct and can be used to start with the Debt Collecting process.

The following transactions should be checked:

- All billing and billing corrections have been done and the correct procedures and items were billed.

- All claims have been sent, all rejections have been dealt with and corrected where necessary.

- All receipts and receipt corrections have been captured. The different types of receipts are

- ERA (Electronic Remittance Advice)

- RA (Remittance Advice)

- Patient Receipts

- Patient Payment Link ERA's

- Refunds, which have been captured and corrected with a Receipt written back if there were mistakes.

- All Unlinked Receipts were linked to the correct debtor accounts and invoices on the debtor accounts.

Using the Account Enquiry / Details to assist in the process audit:

The Account details/Enquiry screen shows all transactions that were processed on an account. This is also the audit trail of the account and can be used to ensure that all the transactions were captured and corrections were completed.

The purpose of the Account Details screen is for the user to access all account-related matters. Medical Debtors with their dependants have one account. All Invoices, Receipts, Corrections, and Journals will reflect on the Account Details screen of the Debtor's Account. This is a summary with totals for each type of transaction processed on the account.

The user can print invoices, receipts or statements, download or email invoices, receipts or statements, make clinical notes, perform special actions, and view the history (archived transactions) of the Debtors Account on the Account Details screen.

The following are some of the functions on the Account Enquiry/Details screen that can be used:

- Account Query: Item Level Summary

- This will provide you with an overview of the Items, Turnover, Receipts (Cash flow) and Journals done on an invoice.

- You can recalculate this summary if necessary by clicking on the Recalculate Summary.

- Account Query: Item Level Allocation History

- This will provide you with an overview of Transactions allocated to items on an Invoice.

- Account Query: Change Item Details

- Change Item Details gives the user the option to remove and change certain details from the Edit transaction detail screen relating to items that have been billed.

- Queries: Totals

- Generates a Totals report of all the outstanding amounts per age: Total, Medical Aid and Patient in a table as well as graph form.

The following processes need to be audited (checked) on a daily/weekly and monthly basis to produce the most successful and up to date debt management.

1. Billing

Ensure that all transactions were billed to the patient's account before claiming. Check that all patient billing is up to date and that no files are misplaced. Ensure that all corrections have been done on the billing and debtor accounts.

2. Claims

All claims must be up to date. The debt management can not start if the claim administration chapter is not done. Ensure that all claims have been submitted. Reverse, Redo, Resend and Resolve where applicable. Ensure all claims have been resolved and the claims that could not be resolved have been shifted to patient outstanding where necessary.

The claims process can be reviewed and checked by following the Claim Administration diagram and chapter in the Practice Management Courses.

3. Receipts

The following type of receipts must be posted and linked to invoice on all accounts:

- Medical Aid Electronic Remittance Advices (ERA)

- Medical Aid Manual Remittance Advices (RA)

- Patient Receipts

- Cash

- Bank Transactions (Card / EFT)

- Payment Link ERA.

This ensures that the correct outstanding amounts are reflected on the accounts. The correct dates must be used so that the outstanding accounts will reflect in the correct period. The age analysis report writer will calculate the age from the correct dates so that the age analysis report will be correct. Please read the chapter on Receipting for more detail.

All Receipt Corrections and Refunds should be finalised. Please read the chapter on Receipt Corrections for more detail.

Draw the unlinked receipt report and confirm all receipts have been linked to their corresponding invoices. This will ensure that only outstanding invoices will be collected. Please refer to the Receipt Correction Chapter on how to work with unlinked receipts. The unlinked receipt report should be empty to ensure that no unlinked receipts are still on the system.

The function in GoodX that can be used to assist the Process Audit:

- Shift outstanding Amount to Patient/Medical Aid:

- When the outstanding amount is on the Medical Aid outstanding and the medical aid is not going to pay the outstanding amount, the amount should be shifted to patient outstanding on the debtor account. This will ensure that the patient is notified that they should pay the account and the collection process is done appropriately.