Best Practice Guidelines: Healthcare Practice Management & POPIA Compliance Framework

Best Practice Guidelines: Healthcare Practice Management

&

POPIA Compliance Framework

Copyright © 2021 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

9. Billing: Roles & Purpose

9.3. Medical Codes & Rules

Understand your Medical Codes & Rules

Medical practitioners do not only have to diagnose and treat their patients, but they also have to spend large amounts of time managing the financial information related to the dispensing of medical supplies, use of the equipment and calculating the rates for different medical procedures. The range of medical procedures and routines that take place in the medical industry is extensive and the result is that the billing process can become quite complicated if you do not have an understanding of how codes and modifiers are used when issuing invoices.

Medical codes are essentially used to describe and categorise the types of services rendered or medicines used to treat patients and to calculate their invoices. When claims are submitted to medical aids, the codes and descriptions are used as references to validate fees and payments. Most codes consist of a code, description and an amount that is allowed to be charged for the different specialities.

A code is a tariff code used by practitioners for services rendered. It can be a group in different categories so that a monetary value can be added to the codes.

The MDCM (Medical Doctor's Coding Manual) is a publication SAMA (South African Medical Association) produces annually and contains all procedural codes, description of the codes, RVUs, Rules, Modifiers, and interpretation for the use of some procedure codes. The MDCM provides us with the RVU (Relative Value Unit) for each code. Every service rendered, is allocated a relative value unit. This compares the relativity between the various services, based on time, expertise, difficulty, etc. The RVU is constant for the service rendered for a specific speciality and may not be changed.

Rules governing the coding structure - Why are Rules used in the coding Structure?

The rules for medical coding ensure that processes are properly followed and that information on the accounts is accurate and correct. It also ensures that the patient's records are accurate and the claim is sent with the correct codes. Here are a few rules but the complete list can be found in the MDCD:

- Rule B: Normal and after hours:

- When non-emergency, elective visits/consultation falls outside of the normal practice hours and is requested by patients for their own convenience, refer to item 0148.

- Bonafide emergency consultation/visit (21:00 - 06:00 daily), refer to item 0149.

- Please note: patients will be personally responsible for payment of the applicable items if these services fall outside the medical scheme benefits.

- Rule D: Cancellation of appointments

- Unless timely steps are taken to cancel an appointment for a consultation, the relevant consultation item may be charged. In the case of a general practitioner "timely" shall mean two hours and in the case of a specialist one calendar day prior to the appointment. Each case shall, however, be considered on merit and, if circumstances warrant, no consultation shall be charged. If a patient has not turned up for a procedure, each member of the surgical team is entitled to charge for a visit at or away from medical doctor's rooms as the case may be.

- Rule E: Pre-operative visits

- The appropriate consultation may be charged for all pre-operative visits with the exception of a routine pre-operative visit at the hospital since that routine pre-operative visit is included in the global surgical period for the procedure.

- Rule G: Post-operative care

- Unless otherwise stated, the units in respect of an operation or procedure shall include normal aftercare for a period not exceeding FOUR WEEKS (after-care is excluded from pure diagnostic procedures during which no therapeutic procedures were performed)

- If the normal after-care is delegated to any other registered health professional and not completed by the surgeon, it shall be his/her own responsibility to arrange for the service to be rendered without extra charge.

- When post-operative care/treatment of a prolonged or specialised nature is required, the benefits, as may be agreed upon between the surgeon and the scheme or patient (in case of a private account), may be used.

- Normal after-care refers to an uncomplicated postoperative period not requiring any further incisions.

- A complication or exacerbation of an underlying co-morbidity that requires care other than normal aftercare for the particular operation, will qualify for a follow-up consultation item. Treatment of conditions such as postoperative pneumonia, pyrexia, wound complications, prolonged ileus (>5 days), DVT, etc, is not considered as part of normal aftercare.

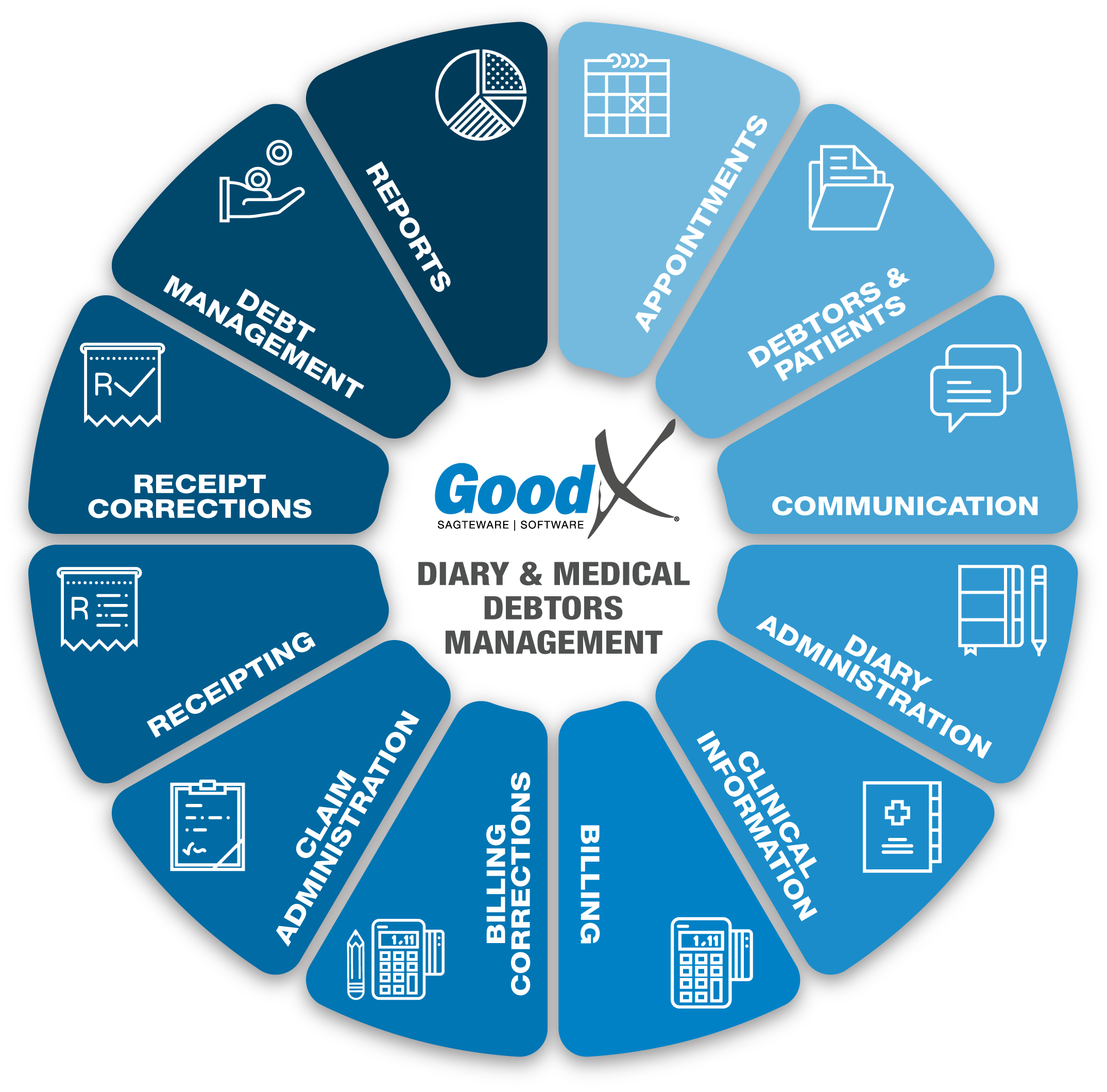

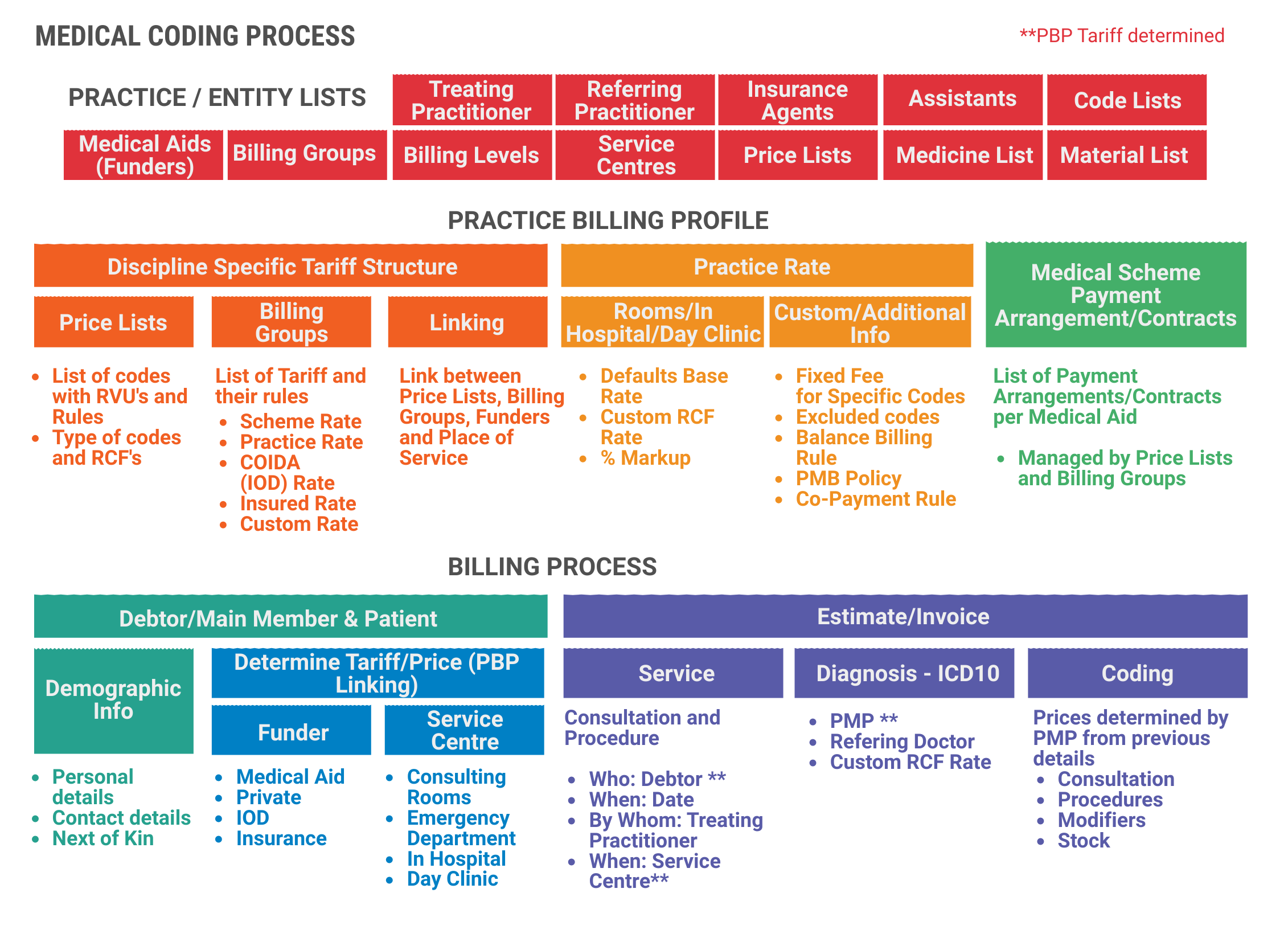

Medical Coding Process

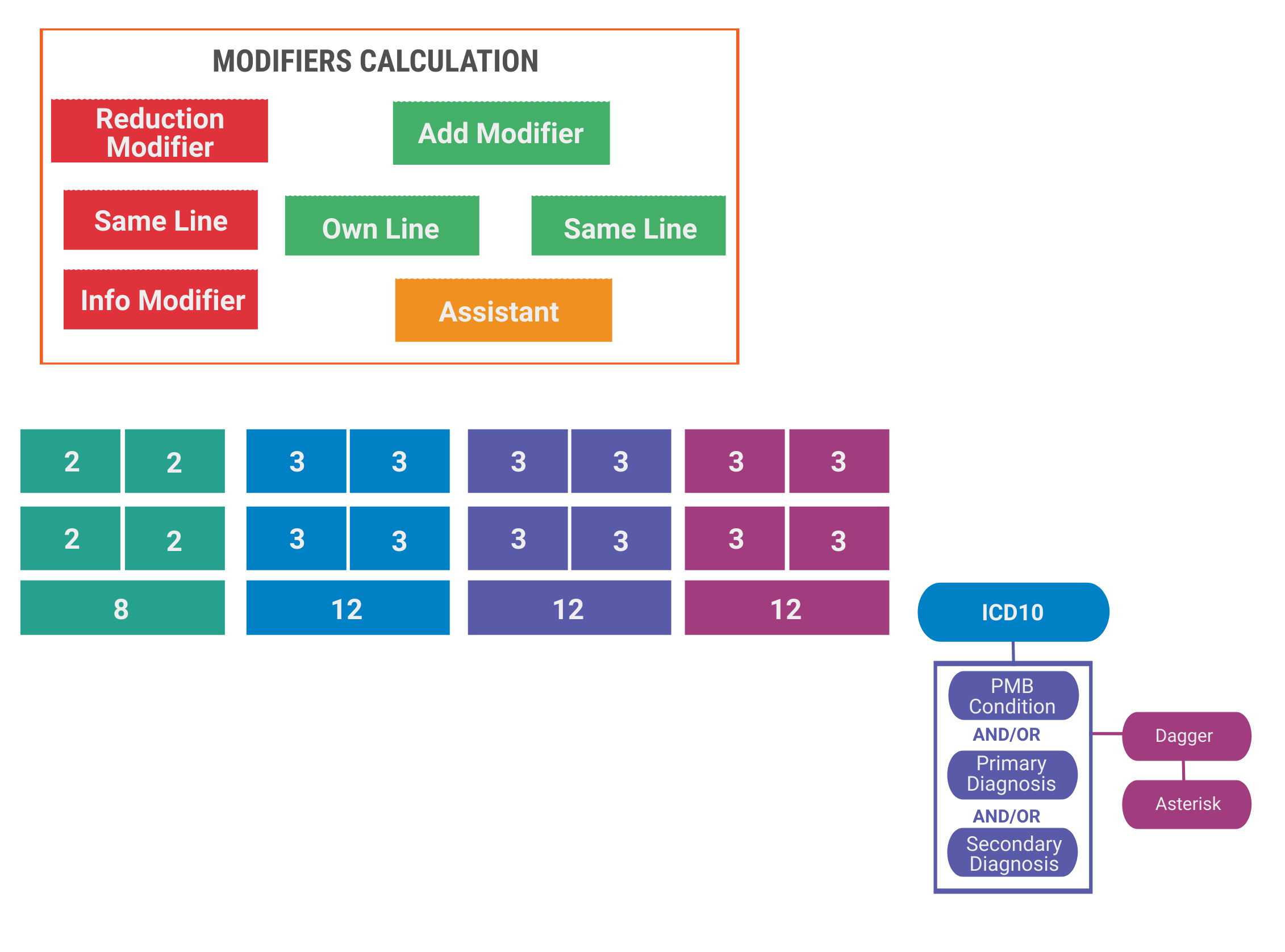

Modifiers are codes that are used by certain medical practitioners in conjunction with their normal codes to modify or change the rate at which they charge patients during a consultation or procedure. Modifiers help to identify instances where the circumstances deviate from the norm. For example, a practitioner may perform more than one procedure during a consultation and use a modifier to adjust the second procedure’s amount. GoodX has built-in functionality to help you configure and manage these modifiers. Incorrect use of modifiers is considered fraud or non-compliance and can result in further audits and revenue loss.

Types of modifiers:

a. Addition modifier

A modifier that adds value, by using a percentage value or a unit value, to a procedure code. This modifier should be added to a separate line with its own value.

b. Compound modifier

Modifiers must be posted on a separate line with their own value but must also be indicated on each procedure code's line where it is applied.c. Information modifier

A modifier that serves to add additional information to procedure codes and has no financial value. This must be added to the same line as the procedure.A modifier that reduces the value, by using a percentage value or a unit value, of a procedure code. This modifier should be added to the same line as the procedure code.

How are codes and modifiers controlled and managed?

The range of medical services that are possible in the modern world has resulted in a wide range of codes and modifiers, each with a possible range of prices and charge types. Codes are analysed and developed by the South African Medical Association (SAMA) and can be found in the SAMA book.

The codes are developed in conjunction with a range of professional bodies and given to the Medical Schemes Council for review, publication and distribution. There are two types of codes:

- RPL (Reference Price List)

- CCSA (Complete CPT for South Africa) and is only used by surgeons.

The following medical code categories are available:

- Consultation Services

- Clinical Procedures

- Materials/Consumables

- Medicines and Prescribe

- Modifiers

- ICD10 Codes

- Claiming Codes

- Other kinds of services

Prescribed Minimum Benefits (PMB)

What are PMBs?

Prescribed Minimum Benefits (PMB) is a set of defined benefits to ensure that all medical scheme members have access to certain minimum health services, regardless of the benefit option they have selected. The aim is to provide people with continuous care to improve their health and well-being and to make healthcare more affordable. PMBs are a feature of the Medical Schemes Act, in terms of which medical schemes have to cover the costs related to the diagnosis, treatment and care of:

- any emergency medical condition;

- a limited set of 270 medical conditions (defined in the Diagnosis Treatment Pairs);

- and- 25 chronic conditions (defined in the Chronic Disease List).

When deciding whether a condition is a PMB, the doctor should only look at the symptoms and not at any other factors, such as how the injury or condition was contracted. This approach is called diagnosis-based. Once the diagnosis has been made, the appropriate treatment and care are decided upon as well as where the patient should receive the treatment (at a hospital, as an outpatient or at a doctor's room).

Why do we have PMBs?

There are two main reasons why PMBs were created:

- To ensure that medical scheme beneficiaries have continuous healthcare. This means that even if a member’s benefits for a year have run out, the medical scheme has to pay for the treatment of PMB conditions.

- To ensure that healthcare is paid for by the correct parties. Medical scheme members with PMB conditions are entitled to the specified treatments and these have to be covered by their medical scheme, even if the patients were treated at a state hospital.

But there are other valid reasons too:

- To provide minimum healthcare to everybody who needs it, regardless of their age, state of health or the medical scheme cover option they belong to.

- PMBs have a part to play in ensuring that medical schemes remain financially healthy. When beneficiaries receive good care on an ongoing basis, their general wellness improves, resulting in fewer serious conditions that are expensive to treat.

- To protect the interests of medical scheme beneficiaries by ensuring, for instance, that schemes first cover essential treatments before setting funds aside for discretionary services.

Responsibilities PMB:

Medical scheme beneficiaries (Member)

PMBs are very good news for medical scheme beneficiaries and give them considerable rights as far as healthcare is concerned. However, as a consumer, you also have certain responsibilities to ensure that PMBs work as well for you as they should.

- First and foremost, educate yourself about your medical scheme’s rules, the listed medication and treatments (formularies) for your specific condition, as well as who the Designated Service Providers (DSPs) are.

- Obtain as much information as possible about your condition and the medication and treatments for it. If there is a generic drug available, do your own research to find out whether there are any differences between it and the branded drug.

- Don’t bypass the system: if you must use a GP to refer you to a specialist, then do so. Make use of your medical scheme’s DSPs as far as possible. Stick with your scheme’s listed drug for your medication unless it is proven to be ineffective.

- Be a good consumer: ask questions and follow the complaints process if you are not treated fairly.

- Make sure your doctor submits a complete account to the medical scheme. It is especially important that the correct ICD-10 code is reflected.

- Follow up and check that your account is submitted within four months and paid within 30 days after the claim was received (accounts older than four months are not paid by medical schemes).

Healthcare providers (Doctors)

Doctors do not usually have a direct contractual relationship with medical schemes. They merely submit their accounts and if the medical scheme does not pay, for whatever reason, the doctor turns to the beneficiary for the amount due. This does not mean that PMBs are not important to healthcare providers nor that they don’t have a role to play in its successful functioning.

- Doctors should familiarise themselves with ICD-10 codes and how they correspond with PMB codes. If you use the correct ICD-10 code your account will definitely be paid as PMBs enjoy guaranteed medical aid cover.

- Consider which option your patients are and what can realistically be covered before recommending a drug or treatment.

- Alert patients to the fact that their condition is a PMB and encourage them to engage their medical scheme on the matter.

- Keep proper clinical records of patients so that when a formulary drug or protocol is not effective or causes adverse side-effects, you can justify your alternative recommendation.

- Do not abuse PMBs. The result will be an unsustainable private healthcare system with unaffordable contribution increases. Abuse could compel the government to consider alternative payment options in the private healthcare sector.

- Allow your practice to be listed as a DSP.

Medical schemes

Among other objectives, PMBs want to achieve appropriate healthcare, resulting in lower costs associated with complications and hospitalisation. When beneficiaries are properly taken care of and their illnesses managed, the need for expensive hospitalisation decreases.

- Medical schemes have a critical role to play in making PMBs work.

- Schemes have to educate their beneficiaries about PMBs and the benefits that are included in them.

- Schemes must inform their beneficiaries of their DSPs and keep them updated should any changes occur.

- Schemes should empower their beneficiaries with information on matters such as the intricacies of rules and the formularies for specific conditions.

- Medical schemes have to guarantee and ensure reasonable access and availability of DSPs.

- The public sector cannot be designated as a DSP without the medical scheme ensuring that the necessary service will be available.

What are emergency conditions?

An emergency medical condition means the sudden and, at the time, unexpected onset of a health condition that requires immediate medical treatment and/or an operation. If the treatment is not available, the emergency could result in weakened bodily functions, serious and lasting damage to organs, limbs or other body parts, or even death.

In an emergency, it is not always possible to diagnose the condition before admitting the patient for treatment. However, if doctors suspect that the patient suffers from a condition that is covered by PMBs, the medical scheme has to approve treatment. Schemes may request that the diagnosis be confirmed with supporting evidence within a reasonable period of time.

Medical aids: Medical aid posting formulas

The Medical Aid Posting formulas are set up per medical aid and will determine if the Procedures/Medicine/Lab code post as Medical Aid liable or Patient liable. For example, when the posting formula is set as medical aid for the procedures, all the procedures will post in the medical aid column as they need to pay. When the posting formula is set as Private for the procedures, all the procedures will post in the private/patient liable column as the patient need to pay.

The fixed-rate Combination / Macro on the web must post to the medical aid or patient liable portion based on the medical aid posting formulas. When setting up a macro, the user does not need to choose values in the medical aid or private columns.

For example:

- Fixed price Macro: (R700)

- code 1 0190 = R500

- code 2 0202 = R200

- When billing this for a Medical Aid patient:

- Total = R700

- Medical aid portion = R700

- Private portion = R0

- When billing this for a Private patient:

- Total = R700

- Medical aid portion = R0

- Private portion = R700

The Macro doesn't need to be fixed private or fixed medical aid, but rather be determined from the posting formula when the tick is on.

Calculation of the Medical Aid Levies

The system calculates the Medical Aid portion of the levy after it has processed the last row in the invoice because the levy rules are sometimes dependent on the final price of the invoice and the number of line items in the invoice.

The calculation of the Medical Aid portion of the levy happens as follows:

- The system “remembers” the practice portion that has already been allocated to the invoice, as sent in from the front-end by the practice.

- An amount that should be paid by the patient according to the rules of the medical aid is calculated by the system.

- If the amount calculated using the medical aid rules is higher than the predefined practice portion, the difference is added to the levy. The value is defined on a pro-rata basis to the individual line items.

- If the Medical Aid is less than the practice portion, the levy is left at the practice portion levy, and no further action is taken.

Take non-preferred provider status into account when dispensing

- Some medical aids classify providers as preferred or non-preferred. Patients generally pay a lower levy if they select to visit a preferred provider, than when they elect to visit a non-preferred provider.

- When a patient visits a preferred provider, they sometimes qualify for a discount on the materials or medicines. The discount calculated after the levy rule originates out of the concept of “fee for service” billing. The idea is that for preferred providers the medical aid pays for the service and that any medicine and/or stock used or dispensed during the service is included in the price of the consultation. Currently, the system will only apply this discount when the discount percentage is set to 100%. Any other value is ignored. The discount feature seems to have been discontinued by medical aids in recent years but is retained for backward compatibility.

- As described above in the Dispensing Preferred provider notes 100% discount may be applied when the provider status is taken into account during the levy calculation.

- The discount value is also supposed to be taken into account for the rule, regardless of whether the discount is set to 100% or not. In this case, the discount is applied before or after the standard levy calculation as defined in the rule. This has not been implemented in the GoodXWeb code.

Some examples of Coding and Billing errors that practice does a lot:

- No documentation for services billed.

- Always assigning the same level of service.

- Incorrect billing for consultations

- Invalid codes billed due to old resources.

- Unbundling of procedure codes.

- Misinterpreted abbreviations.

- No primary complaint was listed for each visit.

- Billing of service(s) is included in the global fee as a separate professional fee.

- Inappropriate or no modifier used for accurate payment of the claim.

Often forgotten rules and modifiers

Rule G - Post-operative care

- Unless otherwise stated, the fee in respect of an operation or procedure shall include normal after-care for a period not exceeding ONE month (after-care is excluded from pure diagnostic procedures during which no therapeutic procedures were performed).

- If the normal after-care is delegated to any other registered health professional and not completed by the surgeon, it shall be his/her own responsibility to arrange for this to be done without extra charge.

- When post-operative care/treatment of a prolonged or specialised nature is required, such fee as may be agreed upon between the surgeon and the scheme or the patient (in case of a private account) may be charged.

- Normal after-care refers to an uncomplicated postoperative period not requiring any further incisions.

Rule C -

Comparable services

- A Service may be rendered that is not listed in this edition of the coding structure. The fee for this shall be based on the fee in respect of a comparable service.

- For these procedures/services, item 6999 applies: Unlisted procedure or service code, should be used. Please contact the SA Medical Association (SAMA) Private Practice Unit via e-mail at coding@samedical.org to obtain a comparable code for the unlisted service.

- This must be accompanied by a special report and must include a wide range of clinical detail.

Rule J -

Disproportionately low fees

In exceptional cases where the fee is disproportionately low in relation to the actual services rendered by a medical practitioner, a higher fee may be negotiated. The use of this rule is not intended merely to increase the Medical Schemes Benefits.

Often Forgotten codes

- 0132 Consulting service, for example, writing of repeat scripts or requesting routine pre-authorisation without the physical presence of the patient (needs not to be face-to-face contact) (“Consultation” via SMS or electronic media included).

- 0133 Writing of special motivations for procedures and treatment without the physical presence of a patient (includes a report on the clinical condition of a patient) requested by or on behalf of a third party funder or its agent.

- 0199 Completion of chronic medication forms by medical practitioners with or without the physical presence of the patient requested by or on behalf of a third party funder or its agent.

- Codes for nerve conduction studies – Musculoskeletal system (for use by Orthopaedics)

- 0733 Motor nerve conduction studies (single nerve).

- 0735 Examinations of sensory nerve conduction by sweep averages (single nerve).

- Codes for nerve conduction studies – Physical treatment (for use by Physiotherapists).

- 3284 Sensory nerve conduction studies.

- 3285 Motor nerve conduction studies.

- 0205 Intravenous infusion in patients under the age of two years does not form a part of the daily ICU/High Care fee and may be charged separately on a daily basis (fee includes the introduction of the cannula as well as the daily management).

Claiming for a consultation on the day of the endoscopic procedure if the procedure was planned during the previous consultation. Rule M applies, Procedure planned to be performed later – This rule indicates that it is not applicable to charge for a second consultation on the day of the procedure.