Best Practice Guidelines: Hospital Patient Administration

Copyright © 2019 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

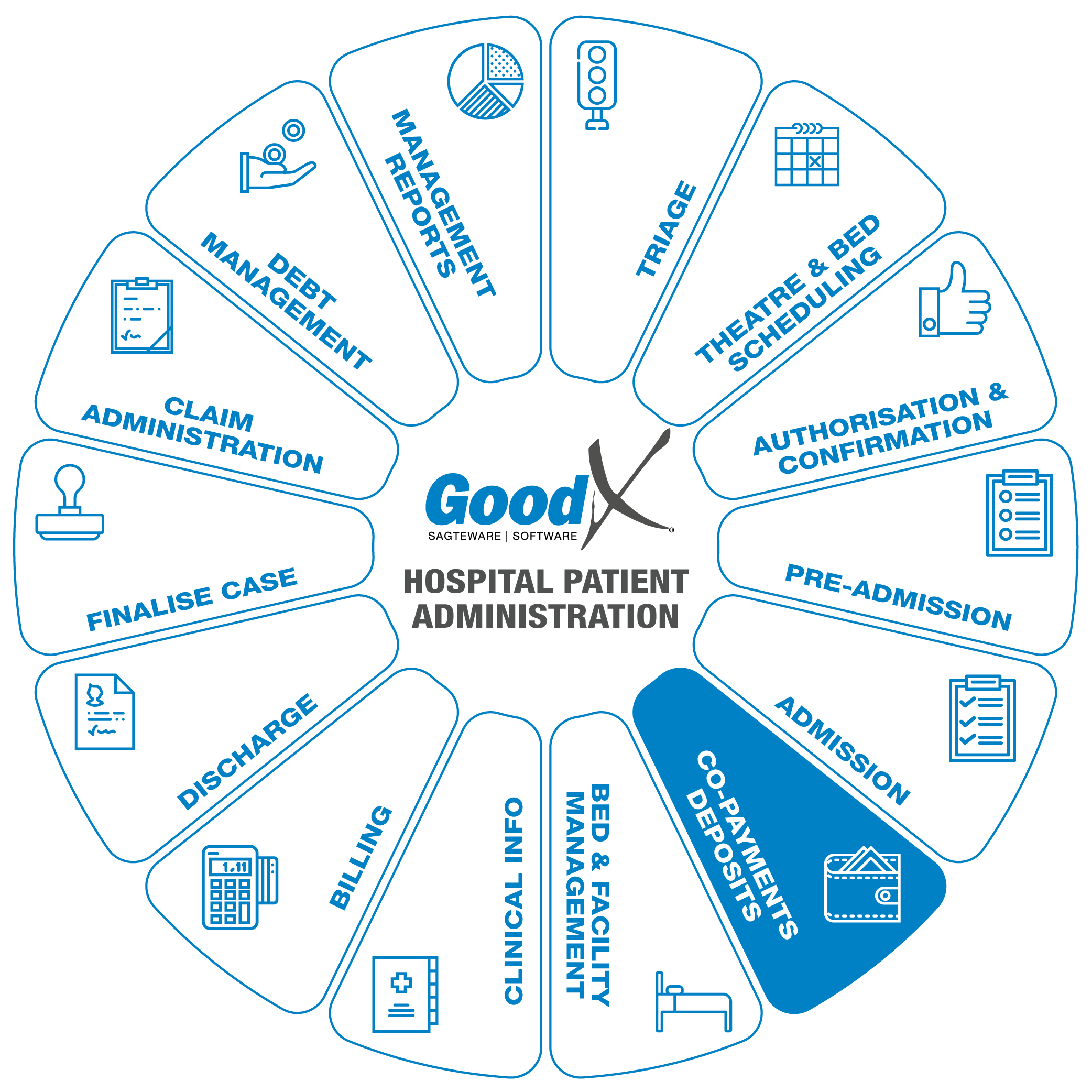

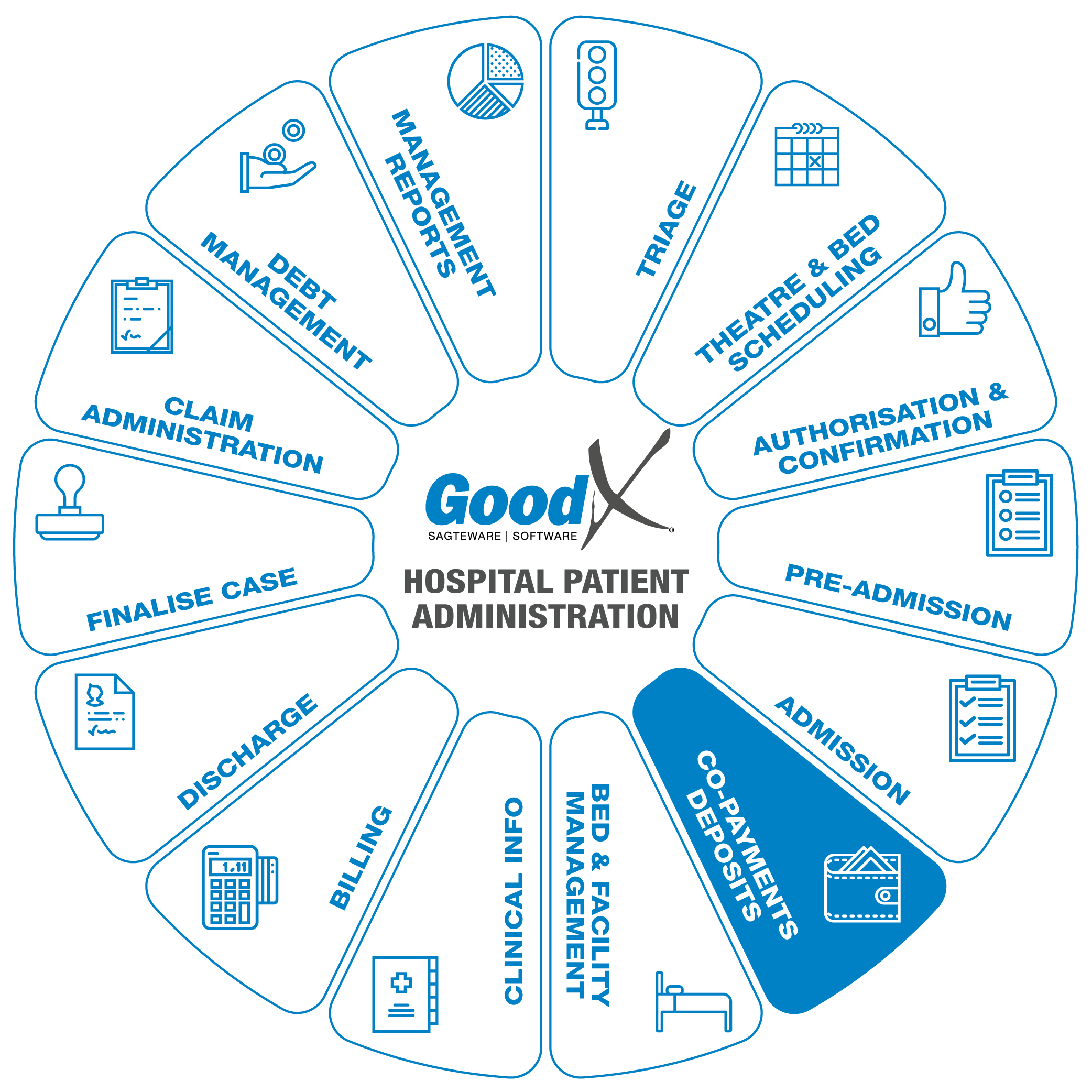

7. Co-payments & Deposits

Responsible Roles

Responsible Roles

Ensure all the cash and card payments are reconciled on a daily basis. Ensure the correct stock for the card machine paper roll are accessible for the reception and the cashier. Ensure a safe place to store the cash, and ensure not to much cash are kept on site.

Ensure the co-payment or deposit were paid to the correct patient's account. Ensure when the unlinked receipt was posted, the receipt must be linked to the correct invoices as soon as the invoices are done.

Check the reconciliation of all cash and card payments received from the cashier or receptionist. Bank all cash into the hospital's bank account. Reconcile back to the bank statement. Ensure a safe place and procedure how cash must be handled in the hospital and between the cashier or reception and the financial manager.

Receive cash and card payment when the cashier is out of the hospital and after hours. Receive the co-payment or deposit from the patient, capture the receipt on the system. Print the receipt for the patient. Reconcile all the cash and card payments before the shift end.

Ensure the patient did pay the co-payment or deposit. Check the co-payment or deposit were allocated to the patient's file. Make sure the reception and cashier know how much the co-payment at each medical aid is and per procedure at all times.

Receive the co-payment or deposit from the patient, capture the receipt on the system. Print the receipt for the patient. When the patient did pay with card, attached the correct card slip to the system receipt. Reconcile all the cash and card payments on a daily basis. Ensure the correct procedure are followed to keep the cash in a safe place at all times. Ensure enough small change in the till for the change the patients may need.

Purpose of Co-payments & Deposits

Purpose of Co-payments & Deposits

Certain procedures have co-payments, the patient must pay to cover some of the cost. Some medical aid plans do not cover all the cost of the procedures, then the medical aid will have a co-payment the patient must pay before the patient can be admitted. A private patient will need to pay a deposit as agreed with the hospital to be admitted into the hospital.

Critical Steps of Co-payments & Deposits

|

Ensure all the cash and card payments are reconciled on a daily basis. Ensure the correct stock for the card machine paper roll are accessible for the reception and the cashier. Ensure a safe place to store the cash, and ensure not to much cash are kept on site. |

|---|---|

|

|

Ensure the co-payment or deposit were paid to the correct patient's account. Ensure when the unlinked receipt was posted, the receipt must be linked to the correct invoices as soon as the invoices are done. |

|

|

Check the reconciliation of all cash and card payments received from the cashier or receptionist. Bank all cash into the hospital's bank account. Reconcile back to the bank statement. Ensure a safe place and procedure how cash must be handled in the hospital and between the cashier or reception and the financial manager. |

|

Receive cash and card payment when the cashier is out of the hospital and after hours. Receive the co-payment or deposit from the patient, capture the receipt on the system. Print the receipt for the patient. Reconcile all the cash and card payments before the shift end. |

|

Ensure the patient did pay the co-payment or deposit. Check the co-payment or deposit were allocated to the patient's file. Make sure the reception and cashier know how much the co-payment at each medical aid is and per procedure at all times. |

|

Receive the co-payment or deposit from the patient, capture the receipt on the system. Print the receipt for the patient. When the patient did pay with card, attached the correct card slip to the system receipt. Reconcile all the cash and card payments on a daily basis. Ensure the correct procedure are followed to keep the cash in a safe place at all times. Ensure enough small change in the till for the change the patients may need. |

Purpose of Co-payments & Deposits

Purpose of Co-payments & Deposits

Certain procedures have co-payments, the patient must pay to cover some of the cost. Some medical aid plans do not cover all the cost of the procedures, then the medical aid will have a co-payment the patient must pay before the patient can be admitted. A private patient will need to pay a deposit as agreed with the hospital to be admitted into the hospital.

Critical Steps of Co-payments & Deposits

Best practice will be to collect Medical aid Co-payment, Deposits and private patient estimates up-front (prior to admission). This will prevent bad debt going forward.

If the authorization/confirmation process was followed, you will be in a position to know exactly what the patient co-payment will be for the specific booked procedure.

A co-payment or deposit can be in Cash, Card or EFT method of payment.

Capture the Cash and Card payments into GoodX with the Cash register or a patient receipt. Please remember that cash and card payments will always be a patient receipt and never a medical aid receipt.

Ensure the correct amount was received, double count the cash, and make double sure the correct amount was typed into the card machine.

Print duplicate receipts from GoodX, one for the Patient as a proof of cash paid and one for the hospital records for the cash received. Card payments will also print 2 receipts from GoodX to give proof of capturing the payment into GoodX and the card machine slips must be attached to the GoodX receipt. The second slip is normally for the Patient (Client copy will be on top of the small slip) and the first slip is normally the hospitals proof that the card payment was processed and approved.

Only capture the receipt for a Card payment into GoodX after the card machine slip show approved. Not according to an SMS on the patient phone or before the card payment was successful.

The following process will be followed when receiving cash and card payments:

Cash register process will be followed when using the cash register module on GoodX:

The Cash register can be set up to work according to workstation or user.

- Workstation setup will be used when the hospital has only one cashbox or till and all the staff members are using the same cashbox or till. there is not a lot of security in this setup, because when the cashbox or till does not balance there

are too many users working with the cash.

- User setup will be used when each user has there owned cashbox or till and have to cash up all the cash and card payments they have received in that session.

The process of the cash register will work as follow:

- Setup the float in the Cashbox or till for the cash

- Open a new session

- Capture the cash receipts and card payments through the cash register every day

- Cash up after every shift change or when the person working with cash leaves the premises.

- Type in the cash into the cash up. Type in the total of the card payments on the printout of the machine what you receive every morning.

- Reconcile the cash and card payments (The reconcile process will be done in GoodX software by running the reconcile process)

- Report any differences and investigate the difference

- Correct the differences in case of know mistakes for instants a receipt capture twice or a receipt that was not captured.

- Close the session

Weekly banking procedure

Best practice will be to bank your cash at least ones a week depending on the number of cash and safety process in your practice.

To bank cash the following process will be followed:

- Decide on the receipt numbers you want to bank

- Print the sessions and add them to get the amount of cash that you need to bank

- Count the cash and ensure that the cash balance back to the total of the sessions that must be banked

- Complete the bank deposit slip with a description that reflects the session numbers or receipt numbers

- Put the cash and the slip in a bag that can close.

- Go to the nearest bank or ATM and bank the cash into the bank account of the hospital

- Make sure the slip has been stamped or the proof that you receive when you bank the cash balance back to the actual cash that was deposited.

Points to consider when working with cash:

- Always have a safe place to keep the cash

- Do not bank always at the same time of the week and hour

- As less as possible people must know that you are working with cash or are on your way to bank the cash

- Drive directly to the bank without any other stops

- If the hospital works with a lot of cash hire a fidelity company to collect the cash at your premises.

- Have security cameras at the points where cash is been kept

The following process will be followed when receiving card payments:

Best practice for a hospital will be to have a card machine, the ability that patients can pay with a card. Some of the payments are too high to have the cash with you. Card payments are safer for the patient and the hospital.

- The card machine will print a long slip once a day when the card machine does auto cash up.

- The slip will have all the card payments for the previous day's card payments as a list and a total, this total will display on your bank statement.

- The card payment slips must recon back to the card payment total slip and to the bank statement.

The following process will be followed when receiving EFT payments:

EFT Payments is when a Patient pay directly into the hospital's bank account with an electronic fund transfer.Points to consider when working with EFT payments:

- Never capture the payment with only a proof of payment from the patient

- Wait till the payment shown in the hospital's bank account before the payment is captured into GoodX.

- Ask the patient to send the proof of payment with an email to the hospital account department.

- Indicate the correct reference the patient must use when making an EFT payment to assist in allocating the payment to the correct patient account.

- The payments will be recon bank once a week back to the bank statement recon.