Best Practice Guidelines: Healthcare Practice Management & POPIA Compliance Framework

Best Practice Guidelines: Healthcare Practice Management

&

POPIA Compliance Framework

Copyright © 2021 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

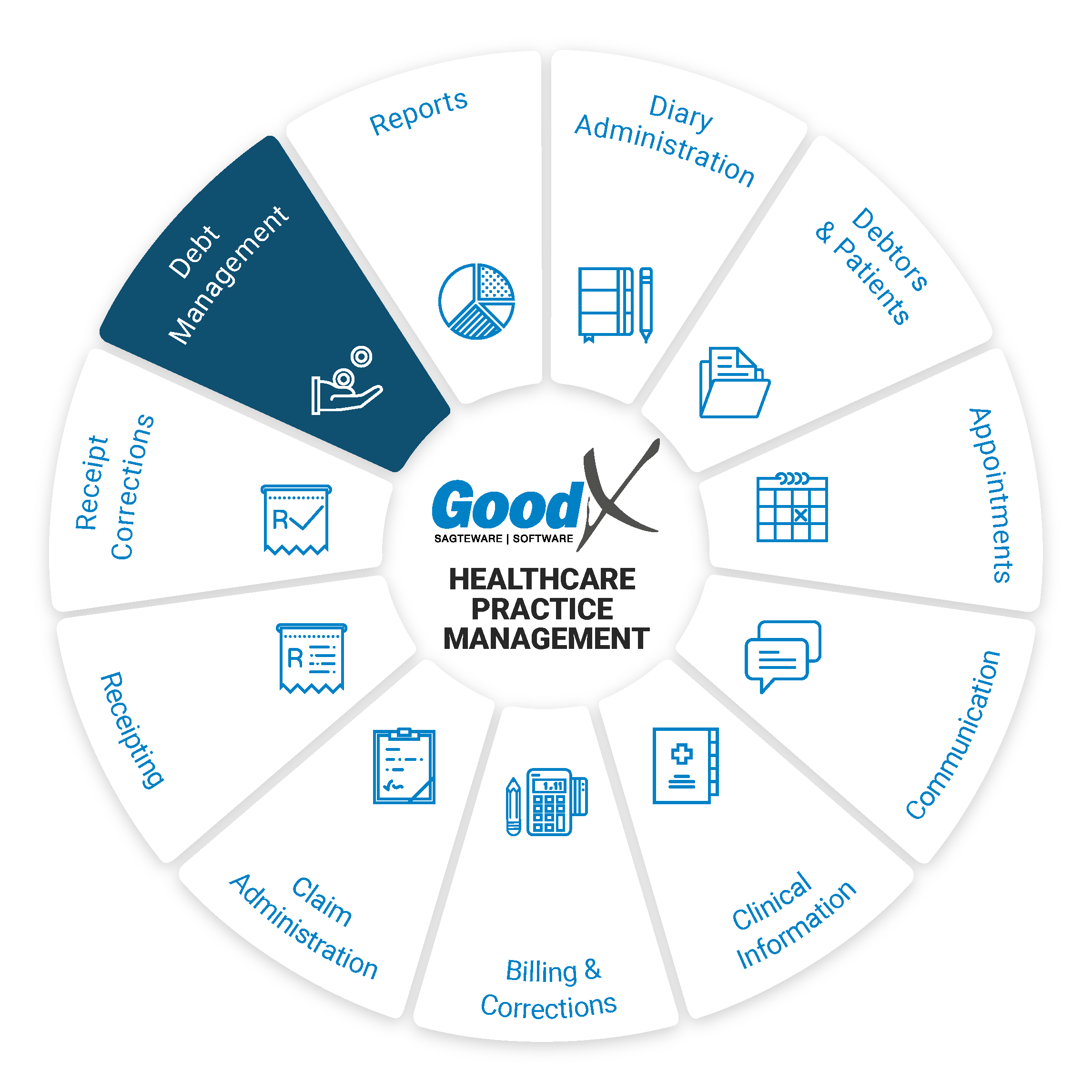

14. Debt Management: Roles, Purpose & Summary of Phases

Responsible Roles

|

Management Role:

|

|---|---|

|

|

Operational Role:

|

|

|

Operational Role:

|

| Action maps: Collection stage:

|

Purpose of

Debt Management

Debt Management is the effective control and administration of patient accounts. It is vital for the financial survival of the business to prevent bad debt and promote a healthy cash flow by collecting outstanding accounts from medical aids and private patients. The longer accounts are outstanding, the less likely it is that outstanding fees and expenses will be collected.

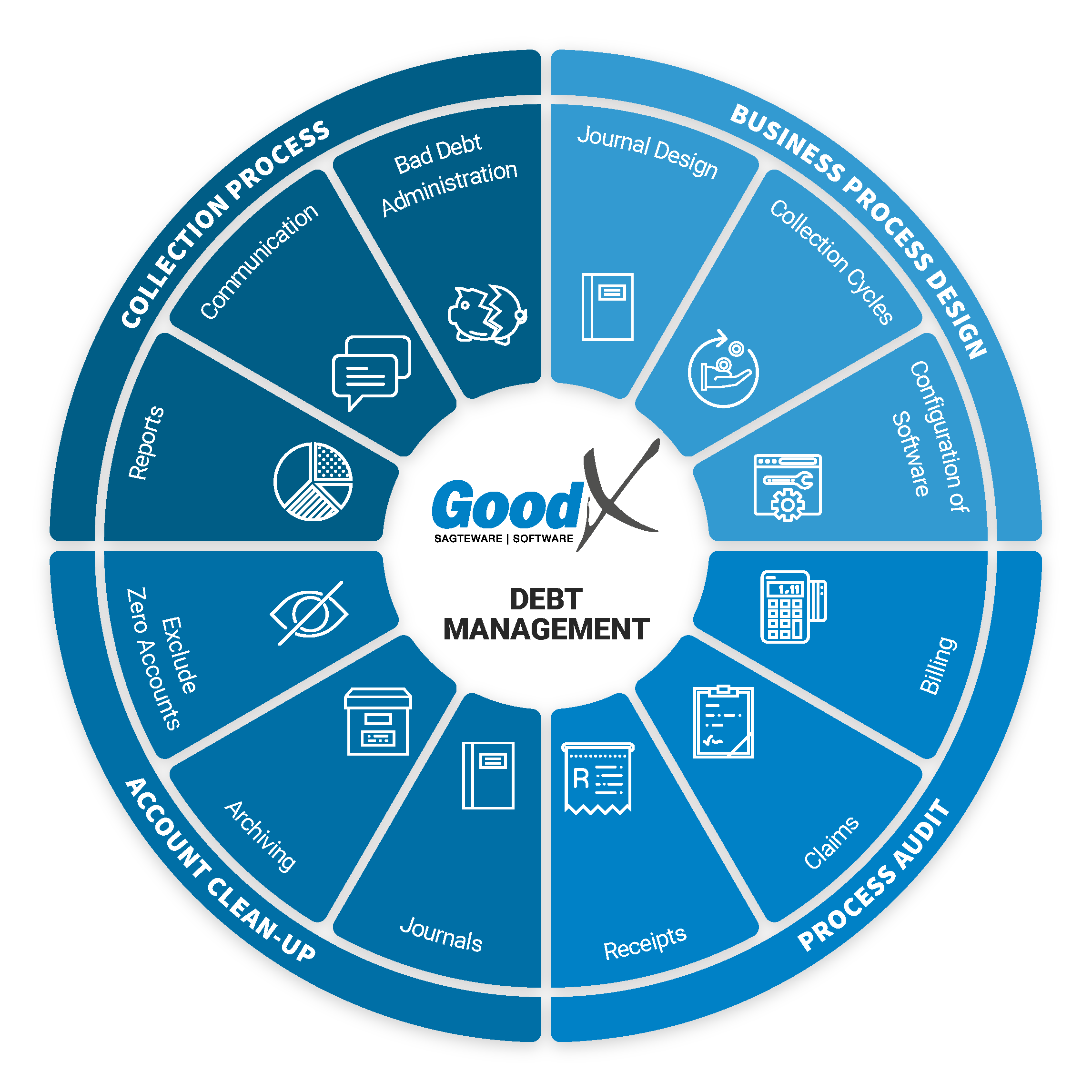

Debt Management Business Process Summary

The Debt Management Business Process diagram is divided into 4 phases, and each phase is divided into processes that need to be followed. The diagram illustrates the following phases:

- Business Process Design

- Process Audit

- Account Clean-up

- Collection Process.

The following sub-chapters will discuss each phase in more detail.

Debt Management Business Process Diagram: