Best Practice Guidelines: Healthcare Practice Management & POPIA Compliance Framework

Best Practice Guidelines: Healthcare Practice Management

&

POPIA Compliance Framework

Copyright © 2021 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

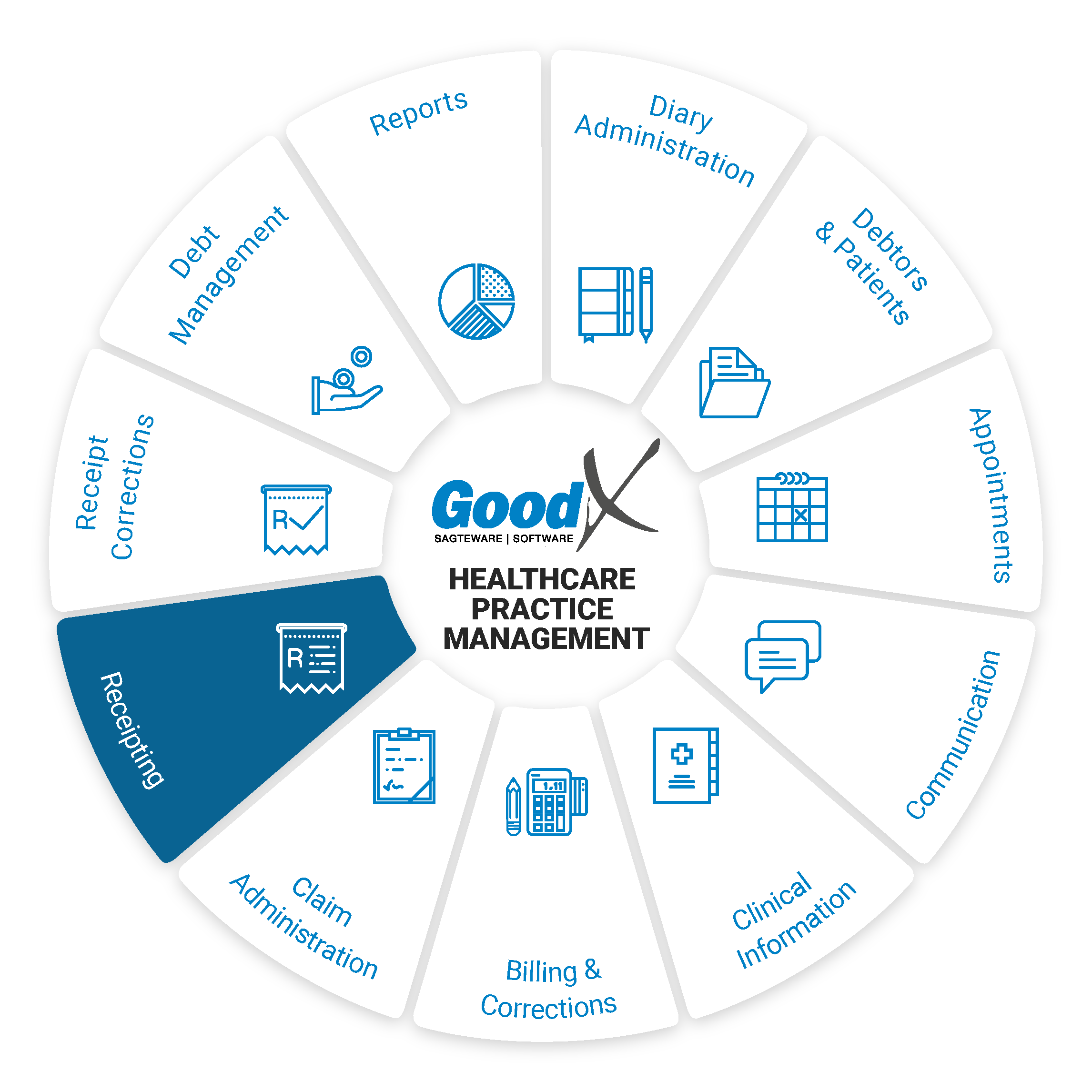

12. Receipting: Roles & Purpose

Responsible Roles

|

Management Role:

|

|---|---|

|

|

Operational Role:

|

|

|

Operational Role:

|

| Action maps: Compliance continuity:

|

Purpose of Receipting

Purpose of Receipting

Receipting is the function used to allocate payments made by Patients and Medical Aids.

There are four types of receipts, namely Patient Receipts (private payments), Medical Aid Receipts (remittance advice to be captured by hand), Electronic Remittance Advices (ERAs) (remittance advice received electronically from Medical Aids and imported into the software) and Online Patient Payments (Payment Link Payments). A patient’s account can reflect both Patient Outstanding and Medical Aid Outstanding amounts.

The function used in the software to capture receipts will depend on whether the patient or the Medical Aid makes the payment.

The receipts will increase the practice cash flow and be used to pay for expenses in the practice. The receipt will decrease the debtor account.