Best Practice Guidelines: Stock Management

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

5. Summary: Stock Purchases (Flowchart)

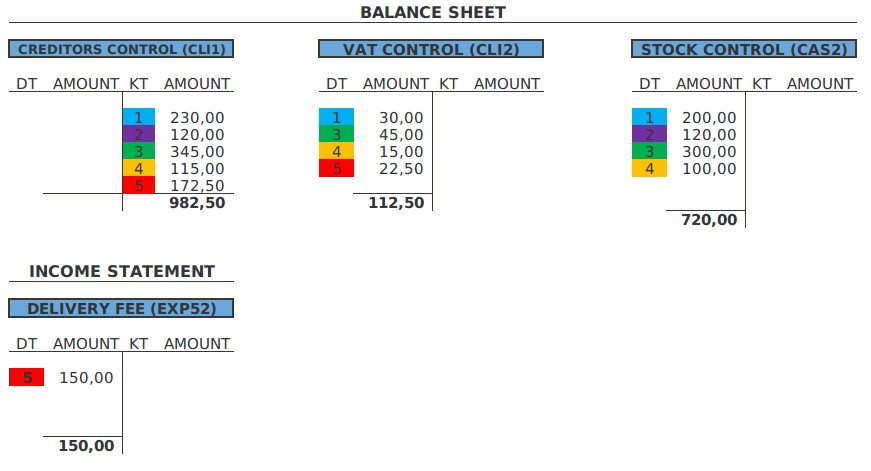

5.3. Ledger Accounts: Stock Purchases

The original transactions take place on the Creditor invoice and line item level. This we call the Detail Ledgers. The transaction will be posted through the Creditor invoice to the correct ledger accounts on the Income statement and Balance sheet, we call this the Main Ledger accounts.

The Ledger accounts that is applicable when capturing a Stock Purchase (Supplier invoice):

- The creditor's control accounts (CLI1)

- The VAT control accounts (CLI2)

- The stock control account (CAS2)

- Expense account for the Non-Stock Items (EXP52 for example)

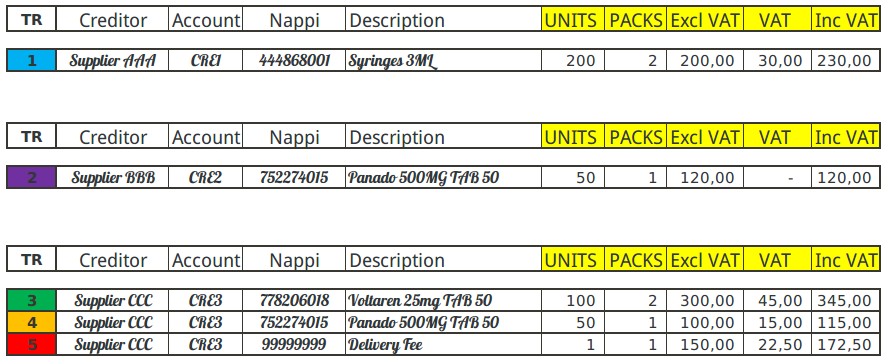

Example of a Stock Purchase

Transaction details

1. Normal purchase at Supplier AAA and we bought 200 Syringes 3ML, for R 230.00 We Received 2 boxes of 100 Syringes each.

2. Supplier BBB is not registered for VAT. We are not allowed to Claim VAT back because the supplier is not registered for VAT. We bought Panado 500MG Tabs. 50 tablets for R 120.00.

3, 4, 5. We bought two items from Supplier CCC and they charged us a delivery fee of R 172.50. We bought Voltaren 25MG Tabs 200 tablets, for R 345.00 and Panado 500MG Tabs, 50 Tablets for R 115.00. The total that we have to pay the supplier is R 632.50.

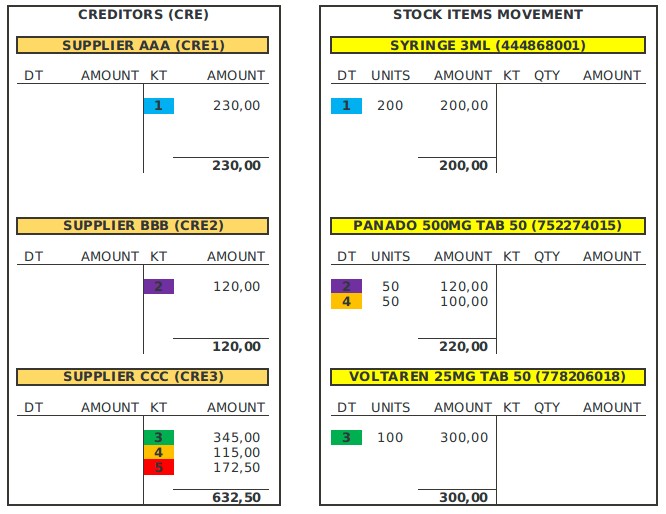

The detail ledgers involved in the purchase of the stock

The detail level adds up to the main ledger accounts