Best Practice Guidelines: Stock Management

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

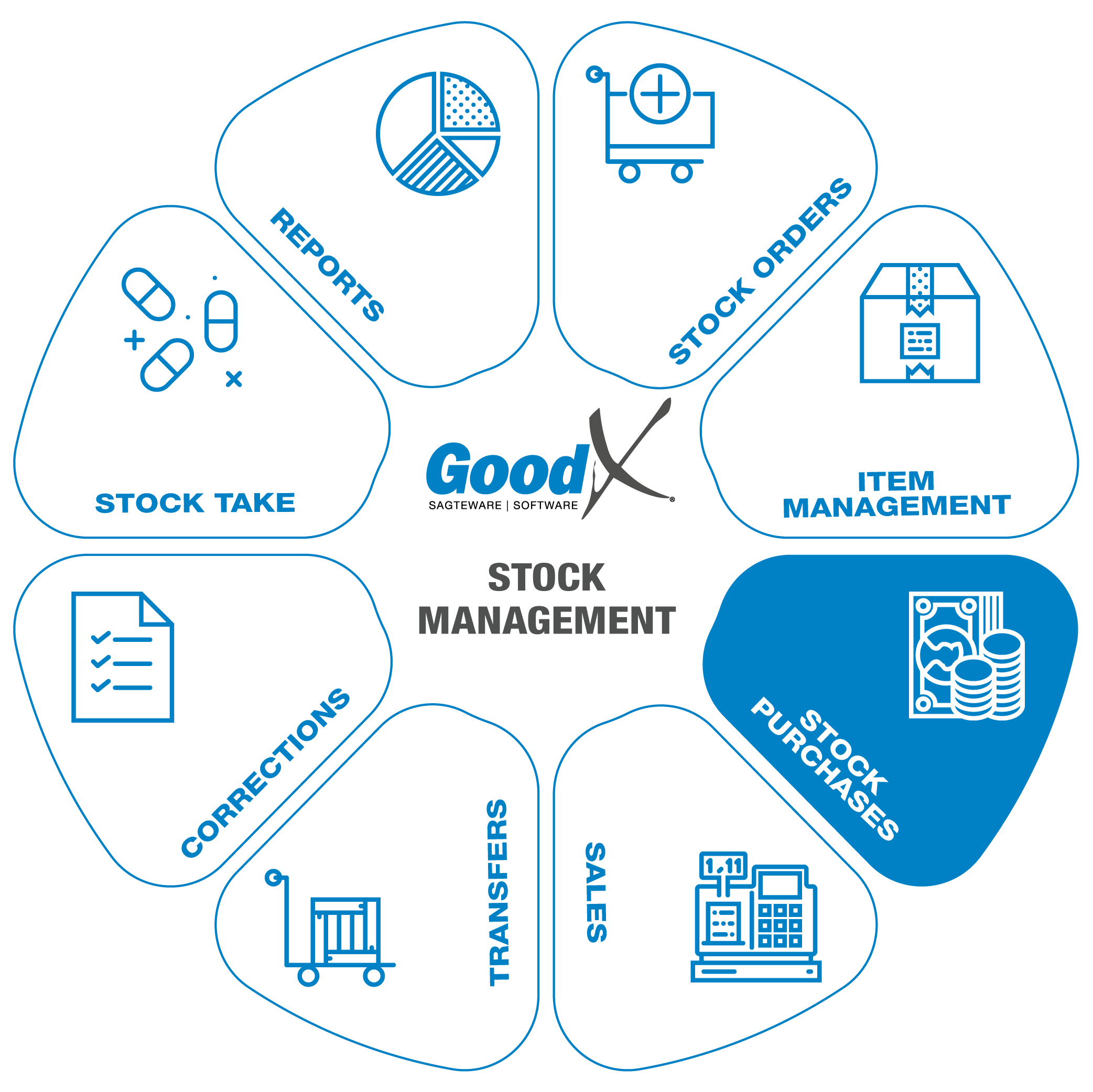

5. Summary: Stock Purchases (Flowchart)

5.1. Stock Purchases

Responsible Roles

|

Ensure the correct prices were invoiced when the stock was purchased from the supplier as per the contract or agreement. Pay the Supplier per invoice and on the correct time period as the agreement. Check the account of the Supplier against the system and reconcile the Suppliers account with the system. |

|---|---|

|

|

Captures the Supplier invoice into the system. Sent through to the Financial Manager to make the payment. Communicate with the Stock Controller that the stock was received. |

|

|

Follow up on the supplier invoice if not received with the delivery of the stock. Ensure the correct information is sent to the Creditors Clerk to capture the invoice and arrange the payment with the Financial Manager. Check if the correct

quantity was captured correctly by the Creditor clerk. |

Critical Steps of Stock Purchases

Critical Steps of Stock Purchases

Stock Purchase is to buy new items for your practice. This will increase your expenditure and increase your stock levels. Using the Stock module to capture the Supplier invoice will assist in capturing the invoice correctly.

GRV is a Goods Received Voucher. This will be created when a Supplier invoice is captured into GoodX.

The best practice will be to buy stock items every 2 weeks. Work with minimum and maximum levels to plan how much you will order every 2 weeks.

Best practice is to ensure that if the person is on leave that captures the Supplier invoices on a daily basis, someone else knows how to capture the supplier invoices to keep the stock levels up to date. If the invoices are not up to date on a daily basis the stock levels will not be reliable and incorrect. Stock management will not be accurate.

Remember to compare your supplier's prices with each other. Keep in mind the Supplier delivery time and distance when you plan your minimum and maximum levels and when you order stock.

When Stock is delivered, please compare your delivery and stock order to ensure that the correct order has been delivered with the correct prices and pack sizes. Damage stock and expired stock must be sent back to the supplier, new stock will be received or a credit note for the incorrect stock will be sent by the Supplier.

When an invoice is captured incorrectly, a stock credit note must be done and the invoice must be recaptured correctly. No stock adjustments must be done when a mistake is made whilst capturing an invoice.

If the Supplier is paid immediately or on a 30 day period, this will still be created as a Creditor to assist in capturing the invoices correctly and keeping the correct stock levels.

Cheques will be created to indicate that the supplier is paid.

When using the Barcodes the items can be scanned to be captured into the system.

Creating the Supplier Account

All suppliers should be opened on the system as a Creditor. The practice will own the suppliers money. When an agreement is signed with a supplier there will be an arrangement between the practice and the supplier. For example:

- The supplier should be paid with delivery

- The supplier should be paid before delivery or after the quotation process

- The supplier will only be paid every 30 days, adding up all the invoices for that period that was captured.

When a Supplier account is created on the system the following should be considered:

- All demographic information should be correct and up to date. The more information on the system the less time will be wasted to find information.

- The account number that needs to be used with payments.

- Is the supplier VAT Inclusive, Exclusive or Exempt. This is an important check and setup.

VAT Inclusive and Exclusive Setup on Suppliers important information:

- Inclusive VAT: When the line item unit price on the supplier invoices is VAT inclusive the supplier must be setup inclusive of VAT. The system will then know the price that is entered into the unit price already has VAT included.

- Exclusive VAT: If the line item unit price on the supplier invoice is exclusive of VAT, the supplier should set up exclusive of VAT. The system will then add the VAT amount to the total of the invoice and each line to balance back to the total of the supplier invoice.

- Exempt: the supplier is not registered for VAT and VAT are not allowed to be claimed back from SARS. The system will know that the amount should not be changed to allow for a VAT portion to be added.

Day to Day Stock Purchases

When capturing the purchase (Supplier Invoice), make sure of the following:

- Correct Transaction date according to the invoice received

- Choose the correct Creditor

- The Invoice number must be the same as the source document, no duplicate invoice numbers will be allowed

- The top amount must equal to the invoice amount, Exclusive, VAT and Inclusive amount till the cent

- The correct items (If the Nappi code is available, please use the Nappi code)

- The pack size according to the system, the invoice and the actual pack that was received

- The correct units

- The correct price per line item

- The VAT must also be correct otherwise the VAT can be changed on the line items

- The line items must balance back to the total of the invoice. The system will not post the invoice if the totals are not correct

- The GRV can be printed if needed, or reprinted from the account screen at a later stage if needed.

- The invoices must be captured as soon as possible after the stock was received

- The system will give a warning if there is a big price difference in the purchase price and the last price the item was bought for. This must be investigated. The system will block the normal user if the difference is over 30% and a supervisor must approve this.

Delivery fee

Some Suppliers will charge a fee for the delivery of the stock items, the delivery fee will be created as a Non-Stock item. It will be captured together with the invoice using a quantity of one and the correct price indicated on the invoice. This will post to the ledger account the item is linked to.

Discount on stock items

The Supplier will give a discount on stock items. The discount can be indicated on the line items when the invoice is captured. The percentage or the amount can be captured and the system will work out the price that was paid for the purchase.

When the supplier is giving a discount on the invoice level and not item level a Non-Stock item can be created to capture this discount and allocated this item to the Discount received ledger account.

Bonus stock

Bonus stock is stock that you receive for free, for example, when you buy 10 units the supplier will give 2 units for free. This will vary from Supplier to Supplier and items.

The bonus stock will be captured into the system as a zero amount but with the correct quantity. Best practice is to capture the 10 items with the correct amount and the other 2 with a zero amount.

This is done to prevent the purchase price of the 10 items, being reduced.

Functions that will be used in GoodX

- List of Creditors (Stock Setup > List of Creditors > Add Creditor)

- Purchase (Purchase > Purchases > Stock Invoice)