Best Practice Guidelines: Accounting Management

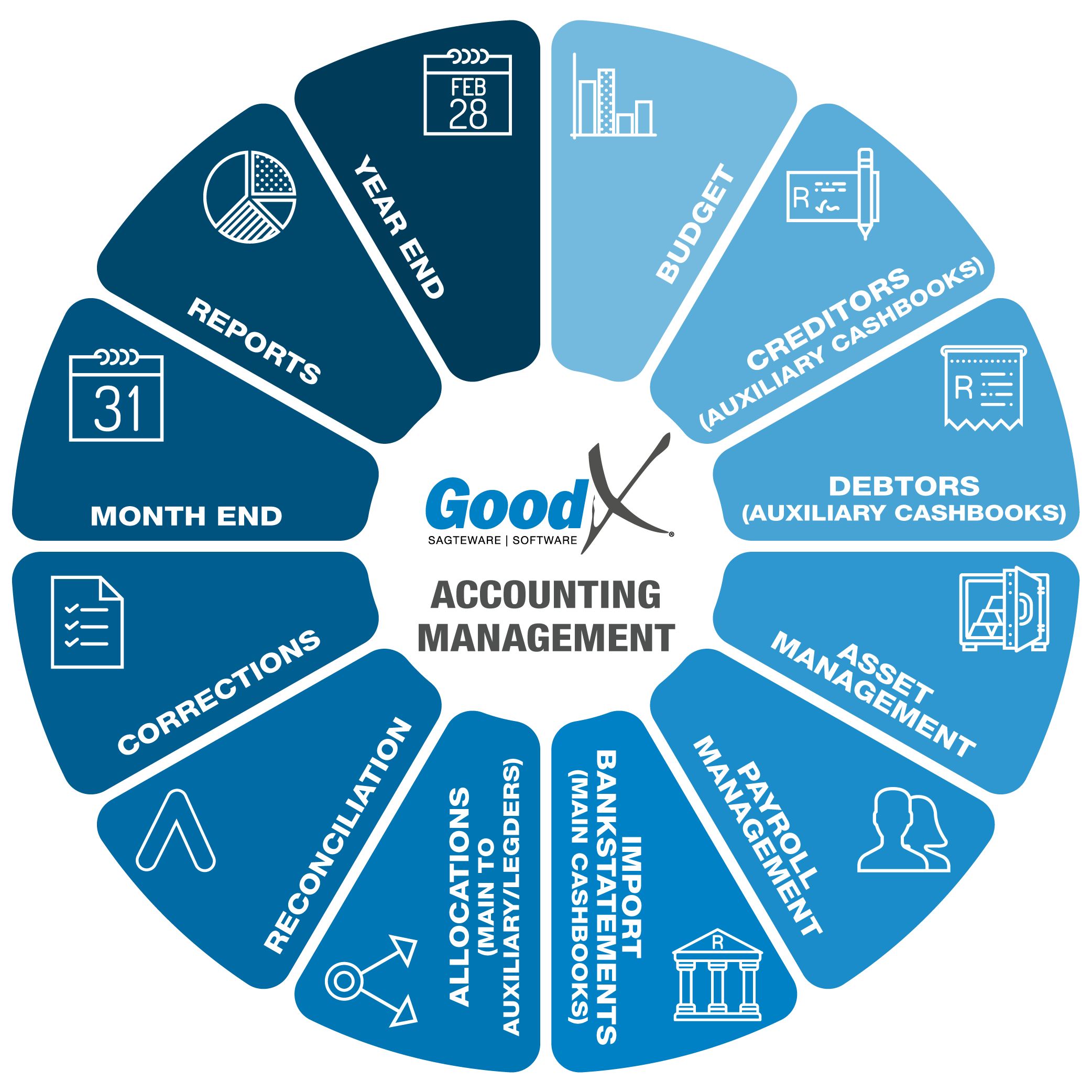

1. Introduction to Accounting Management

1.5. Income and Expenses

Income and Expenses

Income is money that an individual or business receives in exchange for providing a good or service or through investing capital. Income is used to fund day-to-day expenditures

Expenses are Money spent or cost incurred in an organization's efforts to generate revenue, representing the cost of doing business.

Income and Expenditure are used to calculate the Profit or Loss of a Business. You will use an Income Statement to indicate the Profit and Loss of a Business.

Examples of Income:

- Sales and Service income

- Other income

- Rent income

- Interest income

Examples of Expenses:

- Supplies

- Legal fees

- Utilities

- Salaries

- Depreciation

- Insurance

- Entertainment

- Advertising

- Bad Debts

- Fuel

- Rent

- Interest

- License

- Telephone and Fax

- Tax

- Warranties

- Miscellaneous