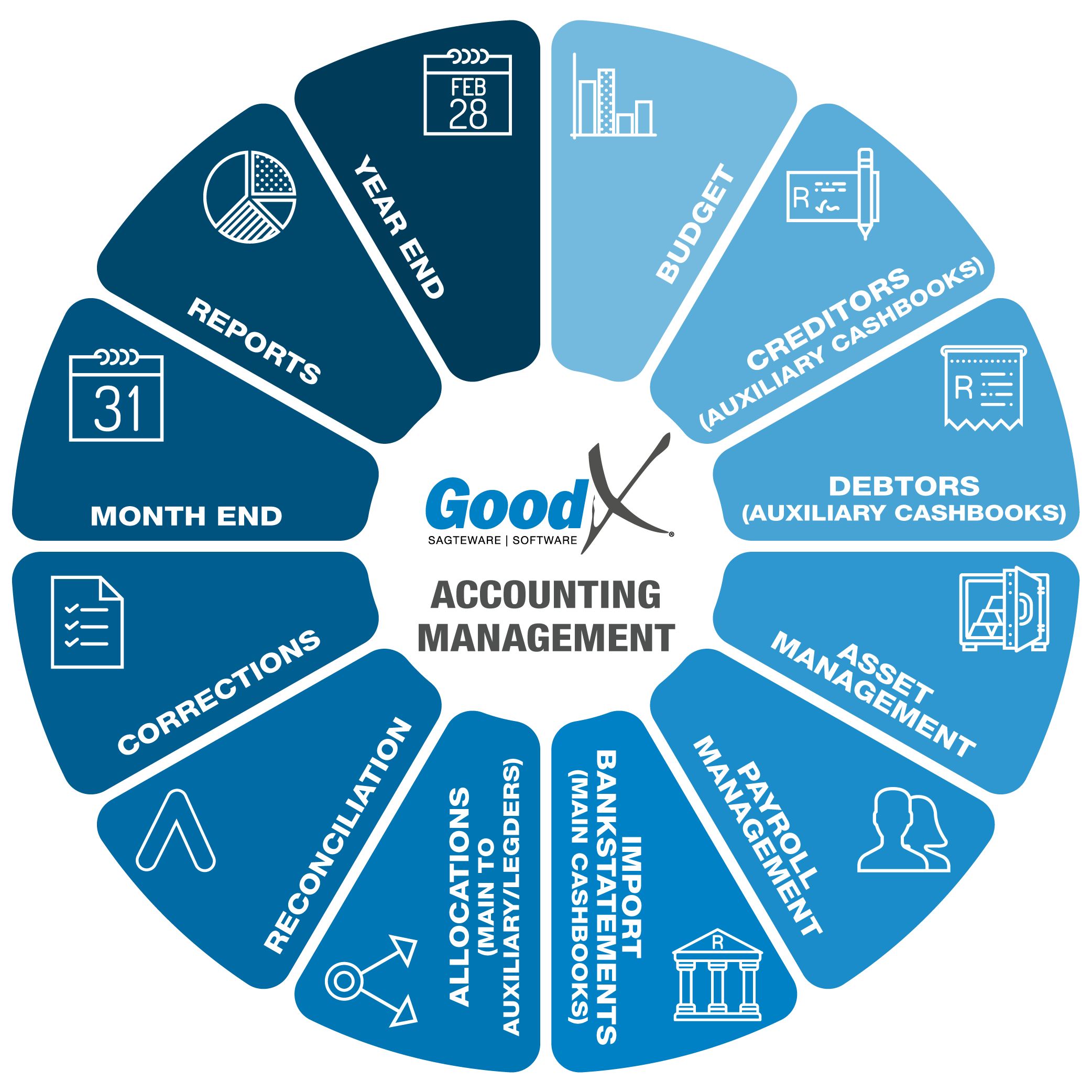

Best Practice Guidelines: Accounting Management

5. Main Cashbooks

What is the Main Cashbook?

- The Main Cashbook is an exact duplicate of a specific bank account. The cashbook will have an opening balance and closing balance for the financial period.

- Normally a Practice will have only one bank account, but if it happens that there is more than one bank account involved, for e.g, an account with ABSA (cheque) and another account with FNB (savings), then there will be a need for two Main Cashbooks.

- The Main Cashbook will also be used for any Loan accounts, Petrol cards, Credit cards and Petty cash.

- Bank statements must be imported on a daily basis to the Main Cashbook via a CSV file.

- An interim debit a credit batch would then be available on the GoodX system was the suitable auxiliary cashbook must be chosen according to the type of deposit or payment made.

Deposits made by the practice for Debtors will be a debit in the main cashbook and will be a credit in the auxiliary cashbook.

Payment made by the practice to Creditors and any other sundry expenses will be a credit in the main cashbook and a debit in the auxiliary cashbook.

Debit batches

- If a deposit was made into the bank account (e.g ABSA) and it was not for a Debtor, then the Income account as stipulated on the ledger must be linked for allocation, e.g Interest received (INCXX).

- If payment was made from the bank account (e.g ABSA) and it was not a Creditors payment, then the Expense code as stipulated in the ledger must be linked for allocation, e.g Bank charges (EXPXX).

- If the deposit on the bank statement is a CASH DEPOSIT, the auxiliary cashbook will be KAS1.

- If the deposit on the bank statement is a CREDIT CARD deposit, the auxiliary cashbook will be KAS2.

- If the deposit on the bank statement is an Electronic Fund Transfer (EFT), the auxiliary cashbook will be KAS3.

- If the deposit on the bank statement is an Electronic Remittance Advice (ERA), the auxiliary cashbook will be KAS4.

Credit batch

- If payment was made from the bank account (e.g ABSA) and it was not a Creditors payment, then the Expense code as stipulated in the ledger must be linked for allocation, e.g Bank charges (EXPXX).

- If payment made was for a CREDITOR, the auxiliary cashbook will be KAS 6.

- If payment made was for PETTY CASH expenses, the auxiliary cashbook will be KAS5.

Main Cashbooks

Bank Account

1. Download the bank statements from your online banking profile on your online banking. Save the file as a CSV file on your computer in a certain folder. You will not be able to import the bank statements if the format is incorrect.

2. Import Bank statement on a daily or weekly basis. The Bank profile must be set up on GoodX.

3. The credits (Deposits) and debits (Cheques) will be split into two batches. The batches will save under exciting batches in GoodX.

4. Allocate all the transactions (line transactions) to the correct ledger accounts or cashbook accounts. A transaction can be split into separate ledger accounts and cashbooks. One payment can be split into different ledger accounts and Cashbook accounts. You can also allocate to the Creditor directly

5. Do the recon of the Bank account

6. Recon the Auxiliary cashbooks

Petty cash - will be allocated the personal drawings or if you have a slip and was for business purpose you allocate the expenses to the correct expense ledger account.

The money will come in from cash that you deposit into your petty cash. The money will go out from Expenses