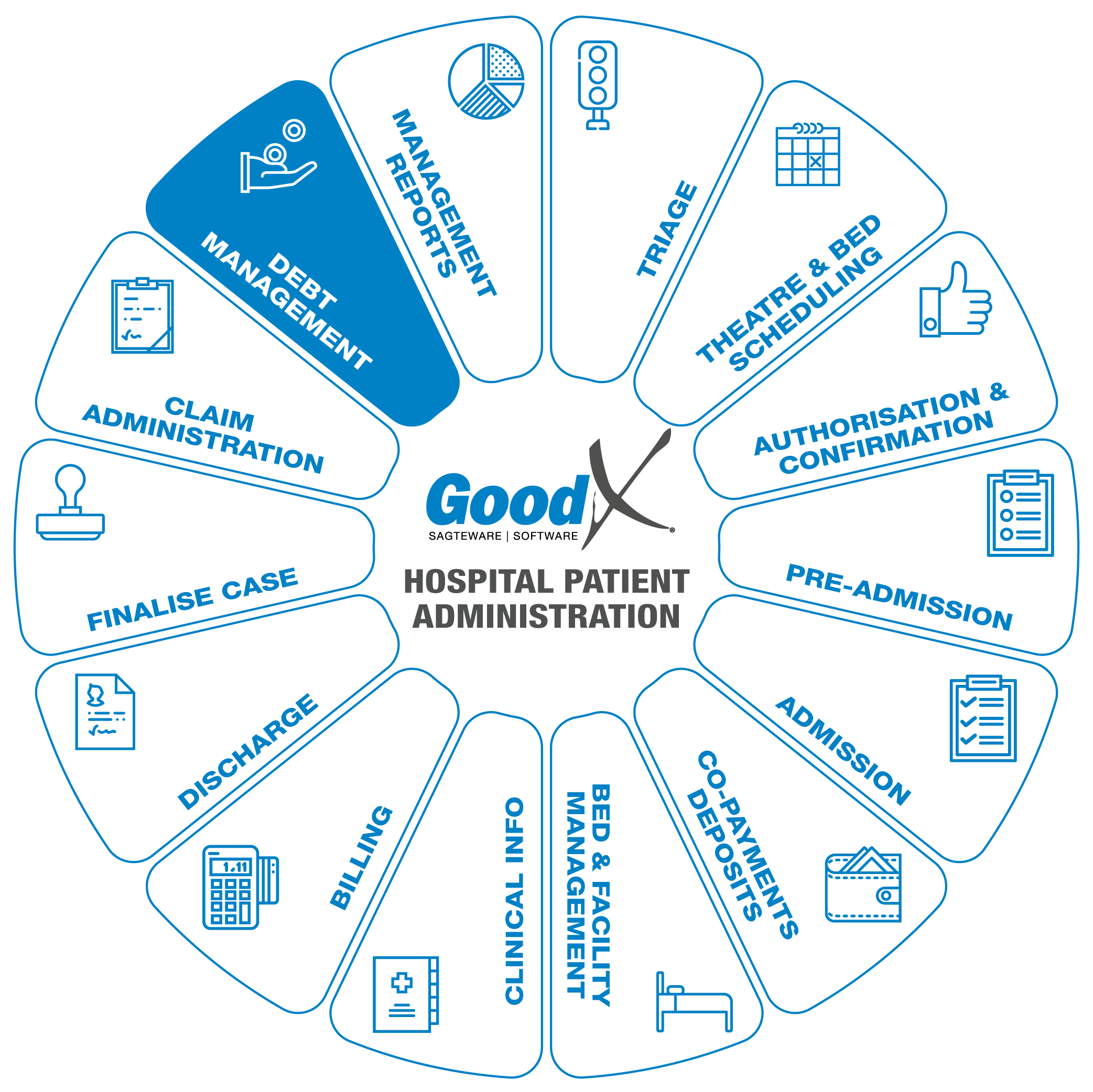

Best Practice Guidelines: Hospital Patient Administration

Copyright © 2019 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

15. Debt Management

Responsible Roles

|

Follow up with the financial manager on all the outstanding debtors. Assist the financial manager where they don't have enough resources to collect the outstanding funds. With the Financial manager discuss and in-force the collection cycles that must be followed in the hospital. |

|---|---|

|

|

Ensure that all process was followed to ensure the outstanding amount to be paid. Hand over the files that can not be collected from the medical aid with the reasons why the medical aid did not pay. Attached all communication with the medical aid to the patient file, authorisation information and updates to the medical aid. This will assist the debtor's clerk to communicate further with medical aids. |

|

|

Follow up on a daily bases all the outstanding accounts. Allocated the outstanding accounts into categories to assist in the correct collection process. Make any notes on the system. Arrange any pay off arrangements with the patients. Follow up on pay off arrangement before the date the next payment must be paid. Sent out SMS and emails to all outstanding accounts. Use all notes what the Case manager have provided to ensure the payment from the medical aid. |

|

Ensure the correct procedures are in place for all the different collection processes. Sign off on all the write-off journals. Ensure the handed over cases are financial positive to be handed over. All discounts must be approved by the financial manager. |

Purpose of Debt Management

Purpose of Debt Management

The best practice is to have no outstanding accounts that need to be handed over to the attorneys for collection. But unfortunately, there will always be a patient not paying the account or the medical aid that are not paying the full account. Debt management assists in keeping the loss at a minimum. The debt management have certain steps that must be followed to ensure the best possible collection on outstanding accounts.

Critical Steps of Debt Management

Debt management will assist in better cash flow and will prevent high bad debt. This process will be called the Credit Control process.

GoodX has 3 types of Age analysis reports:

- Discharge date age analysis - Calculating the age of the account only from the day the patients are discharged from the hospital.

- Finalize date age analysis - Calculating the age of the account only from the day the patient's case has been finalized on the system.

- Current age analysis - Calculating the age of the account as the billing is done on the patient according to capture date/transaction date or financial period.

Credit control process

Monthly statement run :

- Every patient should receive the first account just after discharge at the final billing stage of the account.

- Within the first week after every month-end, all the unpaid accounts on the GoodX system must be posted/e-mailed to patients.

- For all accounts in 60 days and older, there can be a message on the account stating the following. “This account is now considerably overdue, please follow this URGENTLY up with your medical aid. We will have no alternative but to hold you responsible for the payment of this account if it is not paid by your Medical Aid within the next 15 days.†or the correct massages the hospital decided on.

- For accounts where the medical aids short-paid, the following message can appear on the accounts: “Your medical aid did not pay your account in full. Please attend to the payment of the balance within the next 15 days†or the correct massages the hospital decided on.

Telephonic Credit Control – Medical Aids :

If a medical aid account has not been paid within 30 days after the electronic submission, follow up with the medical aids.

On a two-weekly basis phone the medical aids to get confirmation of the following

- Did they receive the accounts

- If, yes – when can we expect a payment, what is causing the delay

- If no, sent the proof of submission to the medical aid with the transmission number.

- If the medical aid still says no, reverse the claim and resend the claim with EDI.

- Always make notes on the system regarding your conversations, time and date and whom did you speak to.

Use the same opportunity to do your queries on short payments, etc

Telephonic Credit Control – Private Patients and Medical Aid Short Payments:

- Ensure that the patient knows about the balance due to the hospital on their account

- Ensure that the patient received a statement

- On a two-weekly basis phone the patients to try and secure payment.

- Always make notes on the notebook in GoodX regarding your conversations.

- Send SMS and Emails out of GoodX to ensure the correct communication channels and automate the notes on the notebook.

The management of your age analysis:

- Draw your age analysis at least every second week.

- Follow up on all accounts in 60 days and older.

- Make sure that there are notes on the system that shows the action taken on these accounts.

Bad Debts Administration:

Best practice will be to have a protocol on Bad Debt, ensure the correct steps and process before an account can be handed over for Bad Debts.

There must be proof of contacting the patient, with SMS, Email and Phone calls at least 3 times with each. In GoodX the notebook can assist in keeping the communication records and be printed or email to the Debt collectors.

When the account is transferred to a Debt collection company or go into a Debt collection process a debtor journal will be done to an expense ledger account - Bad Debts. The patient account will be zero and the Bad debt ledger account will have a balance of the amounts that were transferred o the ledger account. According to SARS, there is a limit on the total Bad Debts a hospital can write off in a financial year. Please confirm this with the Auditor.

Before an account can be handed over for legal action the following needs to be in place:

- Notes on GoodX which serve as proof that all necessary credit control actions have been performed.

- Print the detailed account and all the communication with the patient

- Compile a file with all the communication and account details with all the patient and main member demographic information.

- Send the file to the Debt collecting company or Debt collecting department in the hospital.

Bad Debt recover will be used when a patient that was handed over for bad debts come and settle or pay some of the accounts. The amount will be moved from the Bad debt ledger expense account to the Patient debtor account with a correction debtor journal and then the receipt will be done on the patient account.

Credit control reports

The following reports and functions can assist in the Credit control process :

- Age Analysis

- Notebook

- Statement

- SMS and Email

- Correct and complete patient and main member demographic information

- Credit Control Assistant.

Critical Steps of Account Management

Processing

of Medical Aid remittances

Important steps and information on the processing of Medical Aid remittance:

- When you receive a remittance from medical aid, firstly ensure that the total of the remittance agrees with the total that was transferred into our bank account

- Process the payment on GoodX according to the accounts and amounts as indicated on the remittance by using the manual process or the ERA function.

- Take special note of any short payments on accounts. The medical aids will normally indicate the reason for the short payment with a code. These codes will be treated based on the reason, a list of most codes can be found on GoodX.

- There might be a vast number of other codes and reasons used by medical aids, but the principle is the same, if the remittance is not worked through, there will always have to go back and find reasons and do adjustments relating to previous months, this will have a negative impact on your financial reports.

- You should not file a medical aid remittance if all the queries have been dealt with and sorted out or written off.

- Please ensure that the person in charge of the hospital signs as authorization to do any adjustments to the accounts.

- Also, ensure that the hospital fee structure is correct to prevent billing errors going forward.

- Always put notes on the system.

- Make a note on Good X such as Medical Aid short paid – code: Patients responsibility

- Print the account immediately and post it to the patient/main member or mail it to the main member. Ensure that the following message occurs on account: “Your medical aid did not pay your account in full. Please attend to the payment of the balance within the next 15 days†depending on the process and rules in the hospital's Credit control process.

Non-Chargeable:

- If the medical aid indicates that the short payment is a non-chargeable, ensure that it is, in fact, a non-chargeable and process a journal on Good X as a “Non-Chargeableâ€

Billing Error :

- If the medical aid indicates that the short payment is due to a billing error on our side, investigate the difference

- Communicate with the fund if you do not agree.

- If it was a billing mistake on the hospital's side, process a credit note on GoodX and send the claim again to the medical aid for the short payment.

Processing of patient refunds

Refunds to a patient are when the patient had paid to much and the account is in credit. Never refund a medical aid, the medical aid will in the next payment run deduct the money and take the money back.

- The best practice is to have an authorization process the refund must go through before the payment is made to the patient.

- Double-check the account and make sure of any incorrect billing or hidden fees still not on the patient's account.

- Double-check the banking details from the patient before making the refund.

- Discuss the overpayment with the patient, depending on the patient the credit can stay on the account for the next visit if the visit is in the next financial year.

- Record all the details of the refunds that are done, and record the refund on the patient electronic account to ensure not double refunding.

Processing of debtors journals

Debtor journals must never be used to correct incorrect billing, a credit note must be used. Any Debtor journals must be approved by management before they are processed.

Reasons for valid journals maybe :

- Short payments due to medical aid valid reasons such as non-chargeable & Fee Adjustments

- Bad Debts Written off

- Small balances Written off

- Settlement discount

Month-end cleaning of Age Analysis

The Age Analysis report indicates all the outstanding accounts both Medical aid and Patient outstanding accounts with current, 30 days, 60 days, 90 days, 120 days and 150+ days.

Age Analysis can be set up in different ways to assist in the best possible way to follow up on outstanding accounts.

The best practice is to draw a full Age Analysis with a positive or negative amount, patient or medical aid outstanding at least once a month and follow up on all the details on the age analysis report.

Best practice will be to draw the full age analysis before the financial month are closed to check and handle the following:

Handling of small balances:

Go through all the accounts and prepare a journal “small balances written off†for all amounts R50 and smaller (Depending on the hospital's protocols), this applies to debit and credit amounts. This will prevent these accounts from being printed and posted during your monthly statement run in the first week of every month.

Handling of Settlement Discounts :

Settlement discount will be applied to accounts that were paid on time or paid cash depending on the hospital's protocols. Depending on the hospital's protocols the amount outstanding amount or part of the outstanding amount will be moved to an Expense account - Settlement discount with a debtor journal.

Email statement to patients

A statement month-end run can be done at the end of the financial month. All the statements will print or be emailed depending on the hospital's protocols, to all the patients with an outstanding amount on their accounts.