Best Practice Guidelines: Healthcare Management Internal Controls

Best Practice Guidelines: Healthcare Management Internal Controls

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

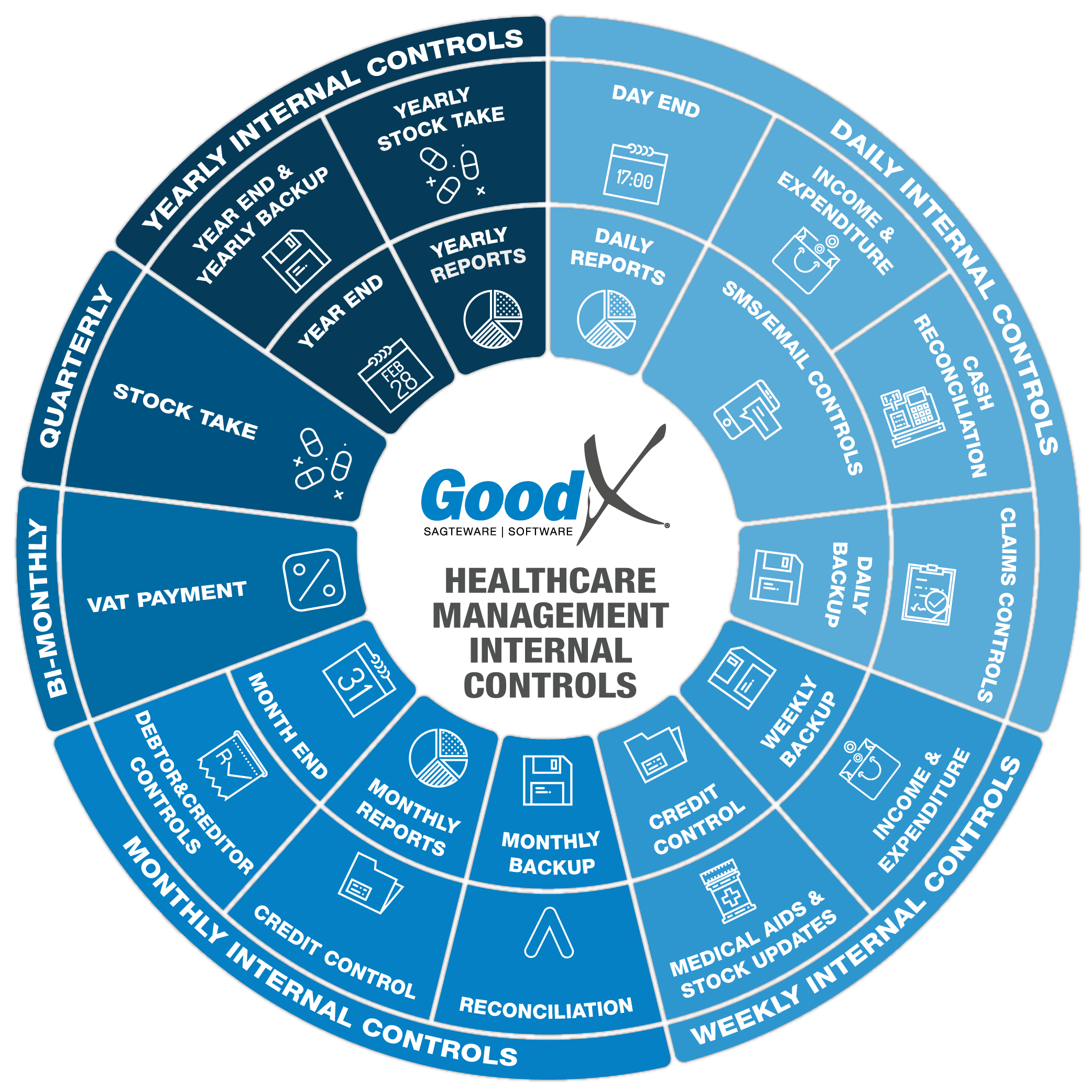

7. Yearly Internal Controls Summary

7.4. Yearly Reports

Yearly reports will be used by the following parties:

- Management

- Directors

- Shareholders

- Auditors

- SARS

Yearly reports have the complete 12-month financial period figures and show the financial state of the practice. Reports must be drawn from period 0 until period 12 to include the opening balance for the financial year. Period 0 will be the closing balance from the previous financial year.

The Yearly reports reflect the financial status of your business. The reports can be used for different reasons, for example:

- Auditing

- Management

- Shares

- The financial status of the business

All the reports can be used for different purposes and combined together. The following reports will be needed at the end of the year:

Age Analysis Debtors

The Debtor Age Analysis must be included in the financial statements to report on the detail of the outstanding amounts that are taken over to the next financial year.

- Ensure all notes are up to date.

- Ensure all patients that have promised to pay statuses, have paid.

- Ensure all handovers have been done.

Age Analysis Creditors

The Creditor Age Analysis must be included in the financial statements to report all the expenses that must be paid in the next financial year.

- Check why the creditors were not paid in full at the end of the financial year.

- The creditors are a financial liability for the practice.

Stock on Hand

The Stock report writer is used to calculate the Stock on hand, in other words to calculate the stock quantities and Rand value per item up to the day of generating the report. The Stock on hand report will be sent to the financial auditors and the report will be included in management reports.

The following checks must be done to ensure the report has valid information:

- No negative quantities.

- No negative values.

- Double-check the high-value items, to ensure the values and the quantities are correct.

- Double-check the high-quantity items, to ensure the quantities and values on items are correct.

- Check if the total value on the stock report writer is balancing with the stock control ledger account for the same period or the same dates.

- Check and correct items with a zero quantity but has a small value (due to weighted average calculations)

- Check that all the settings and filters are correct.

- The values and quantities that need to be checked are in the YTD Qty and YTD Value columns.

1. Income Statement

An income statement reports on the two elements of financial performance, which is revenue that was earned and expenses that were incurred to earn the revenue. The difference between revenue and expenses results in the profit or loss for that specific period. The various types of revenue and expenses are shown as separate items in the income statement.

The Income ledger accounts start with - INC

The Expense ledger accounts start with - EXP

The income statement reflects in short the income of the entity as well as the expenses incurred to generate that income.

Income and Expenditures are used to calculate the Profit or Loss of a Business. You will use an Income Statement to indicate the Profit and Loss of the business.

The profit earned by the business increases capital and the losses the business incurred will decrease the business capital.

2. Balance Sheet

The first part of the balance sheet reflects the assets of the entity while the second part reflects the sources from which the assets were financed.

Two main types of sources of finances are distinguished namely equity and liabilities. The contribution by the owner is equity. Equity represents the interest of the owner(s) in the assets of the entity.

Liabilities are the amounts owing to creditors, for purchases or services received which are to be paid at a later stage, or financial institutions from which the entity borrowed money.

The balance sheet, therefore, reflects the three elements of the financial position: assets on the one hand and equity and liabilities on the other hand.

Accounting equation:

Assets = Equity + Liabilities

What the business has, or owns, is called Assets. How they are financed will indicate if this is a Liability or Capital/Equity.

- By the owner = Capital/Equity

- By other persons (Individuals, Suppliers, Banks etc) = Liabilities

3. Trial balance

The Trial balance is a combined report between the Income Statement and the Balance sheet.

In order to prevent errors and to make sure that all transactions are properly recorded as debits and credits in the correct T-accounts, a checking procedure takes place at the end of each accounting period. This is known as preparing a trial balance. A trial balance is thus a list of all the debit and credit balances in the general ledger accounts. If all the individual double entries have been correctly carried out, the total of the debit balances should always equal the total of the credit balances in the trial balance.

The trial balance will indicate the big picture of the financial status of the business.

The year-end trial balance is typically requested by auditors when they begin an audit so that they can transfer the account balances on the report into their auditing software. They may ask for an electronic version, which they can more easily copy into their software.

The trial balance will have the following divisions:

ASSETS

Examples of Current Assets

- Cash

- Cash Equivalents

- Short-term Investments

- Stock/Inventory

- Marketable securities

- Supplies

Examples of Non-Current Assets or Fixed Assets

- Land

- Buildings/Vehicles

- Furniture and Fixtures/Equipment/Machinery

- Accumulated Depreciation (a contra-asset account)

- Long-term Investments

- Goodwill

- Allowance for Doubtful Accounts (a contra-asset account)

LIABILITIES

There are two types of Liabilities:

- Current Liabilities (Short-Term Liabilities) are due in one year.

- Non-Current Liabilities (Long-Term Liabilities) are due over more than one year.

Examples of key ratios that use current liabilities are:

- The current ratio: Current assets divided by current liabilities.

- The quick ratio: Current assets minus inventory divided by current liabilities.

- The cash ratio: Cash and cash equivalents divided by current liabilities.

Examples of Current Liabilities

- Short-term Loans Payable

- Current Portion of Long-term Debt

- Accounts Payable

- Accrued Expenses

- Instalment Loans Payable

- Warranty Liability

- Income Taxes Payable

- Lawsuits Payable

- Bank accounts overdrafts

Examples of Long-Term Liabilities

- Mortgage Loans Payable

- Bonds Payable

- Long-term notes payable

- Capital Lease

- Deferred tax liabilities

4. Ledger report (Audit Trail)

A Ledger report is a detailed report with all the different ledgers and all the transactions in those ledgers for a certain period.

A ledger report can be drawn per ledger. The detail on the ledger reports can be used for Audit purposes. The report can also be drawn as a Summary report.

Some of the detail you will see on the Ledger reports:

- Opening Balance

- Dates (Transaction, Capture and Period)

- Descriptions

- Grouping details

- Debit Amounts

- Credit Amounts

- Running Total

- Ledger Account Total

- Ledger account number

- Document Number and Source Number

- Financial year

- VAT Amount

- Closing Balance

The ledger reports can also be used to search for transactions that were posted to the incorrect Ledger account.