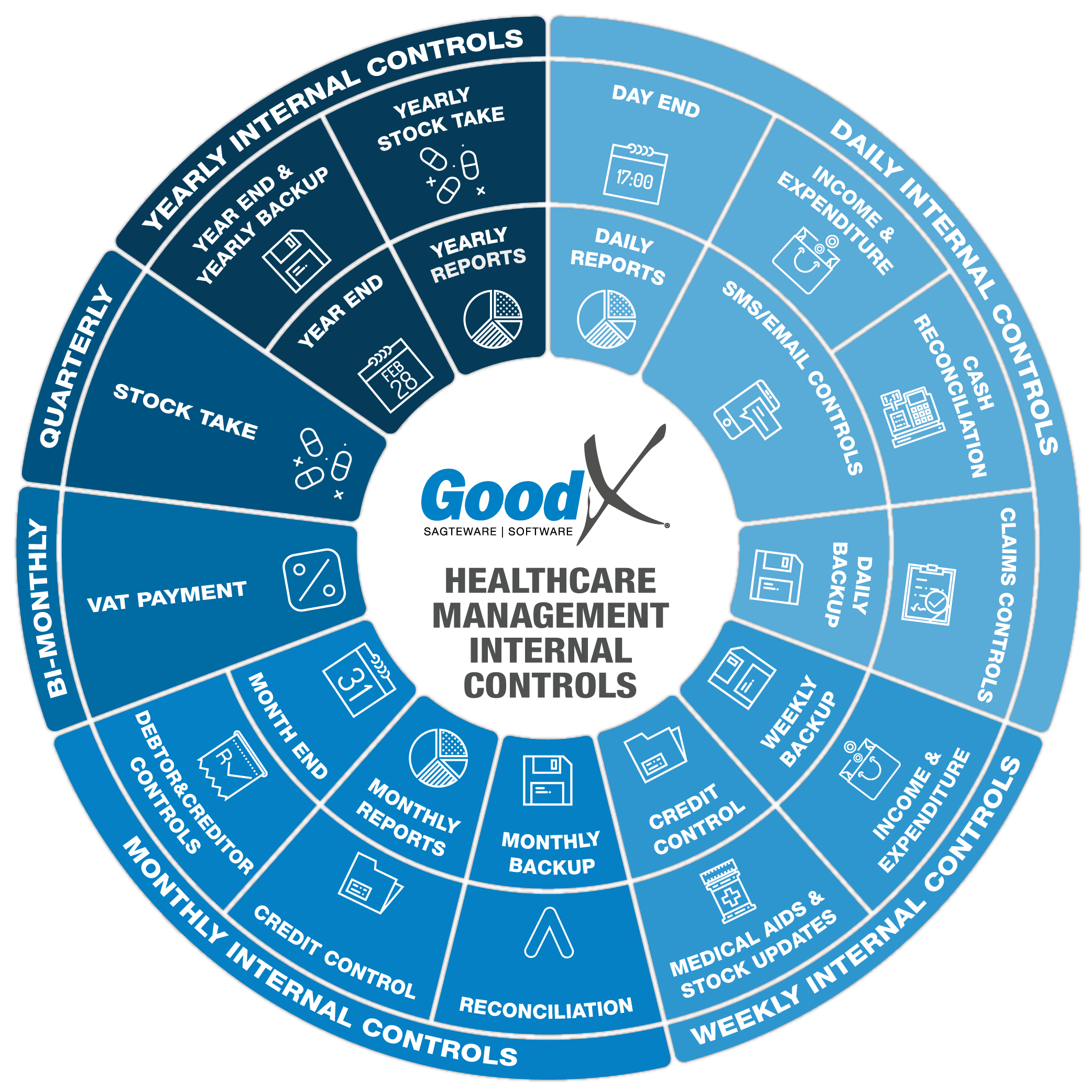

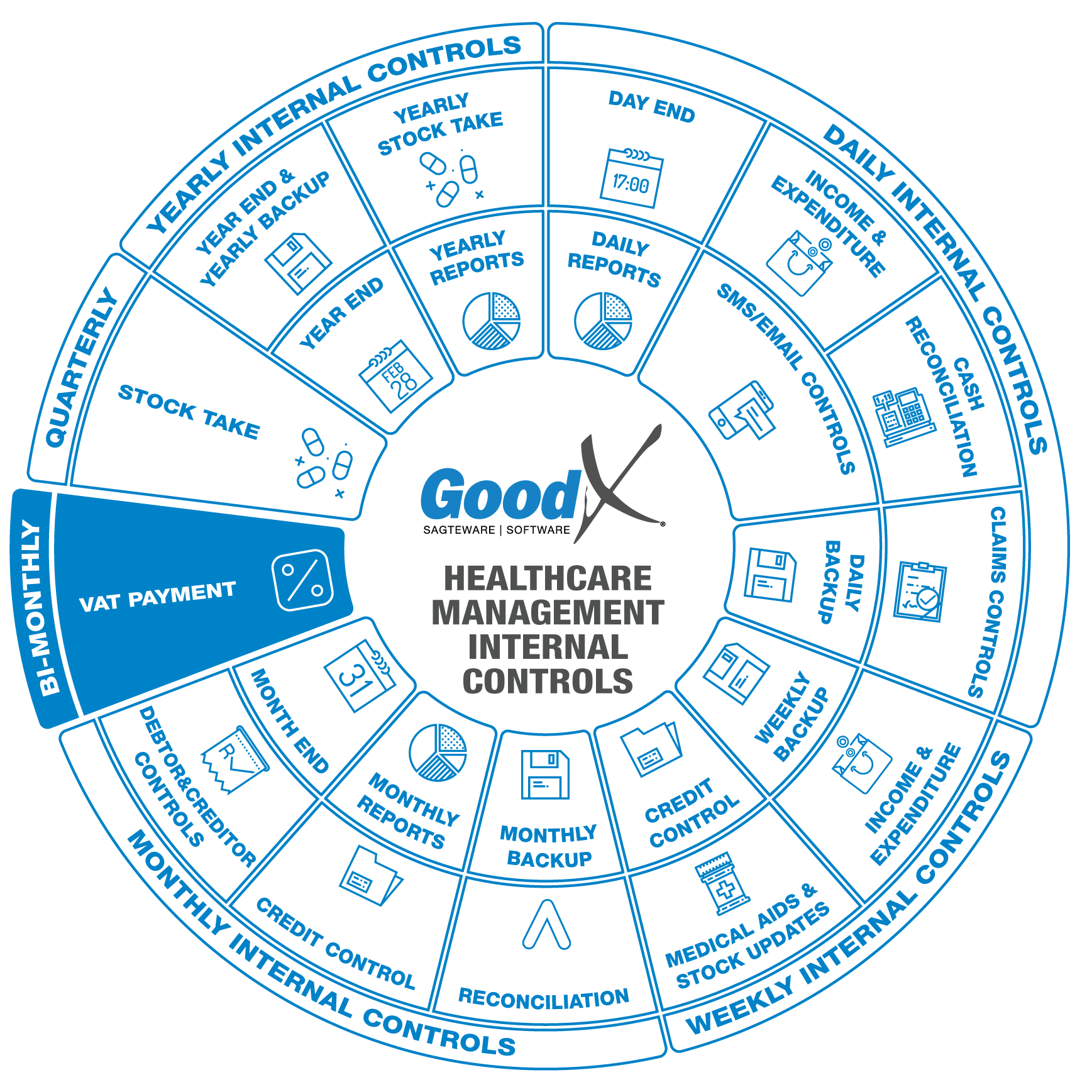

Best Practice Guidelines: Healthcare Management Internal Controls

Best Practice Guidelines: Healthcare Management Internal Controls

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

5. Bi-monthly Internal Control: VAT Payment

Value Added Tax (VAT) is levied at the standard rate of 15% on the supply of goods and services by registered vendors. The tax rate increased from 14% to 15% on 1 April 2018. Depending on how the practice is registered with SARS, the practice will be responsible to pay or claim back VAT every 2 months (bi-monthly).

Most practices are registered for Invoice method and should therefore pay VAT calculated on the invoices generated.

Invoice or Payment basis VAT calculation

"The invoice basis and the payment basis are the two available methods of calculating your VAT liability i.e. the amount payable to SARS or the amount refundable by SARS on your VAT return. Vendors are generally required to account for VAT on the ‘Invoice Basis’. However, a vendor may account for VAT on the payment basis if the vendor meets the prescribed requirements."

(See http://www.sars.gov.za/AllDocs/OpsDocs/Guides - Guide for completion of VAT application)

The payment basis may only be chosen by a:

- Public Authority, Municipality or Association not for gain.

- A natural person with total taxable supplies of less than R2.5 million per annum.

Output Tax and Input Tax

Output Tax is the VAT on sales, if the practice or company is registered for VAT at SARS. Output Tax must be calculated on all sales or service that the practice or company sells or supplies.

Input Tax is the VAT on expenditure, if the practice or the company is registered for VAT at SARS. Input Tax will be added on the slip or invoice for services rendered to the company or practice or goods delivered to the company or practice. The supplier must be registered for VAT, otherwise you will not be able to declare the VAT on the purchase.

Output Tax must be paid to SARS and Input tax can be claimed back from SARS. You will complete a VAT201 form on SARS eFiling. The Input Tax will be deducted from the Output Tax and the company or practice will pay the difference or claim back the difference.

Process Bi-Monthly VAT Control

- All transactions must be up to date and captured into the software

- The transactions for the previous two months will be calculated, all income minus credit notes and expenses minus debit notes.

- The VAT calculation will be available in the VAT report.

- The VAT report will indicate if the practice must pay VAT to SARS or claim VAT from SARS.

- The VAT201 form must be completed and submitted through eFiling.

- The VAT report on GoodX will assist you to complete the VAT201 form with the correct amounts.

- The VAT must be paid electronically to SARS before the last payment date to avoid levies and penalties.

- Follow up asap with SARS to make sure they received the payment.

The following must be checked:

- All transactions that have VAT.

- All transactions that are VAT exempt.

- All transactions are Zero VAT.

- No backdating transactions.

- Ensure the month end was done on the correct date.

- It will be more beneficial for the practice to buy from a VAT registered business.

- Check the payment that was made to SARS.

- Ensure the payment was captured in the system.