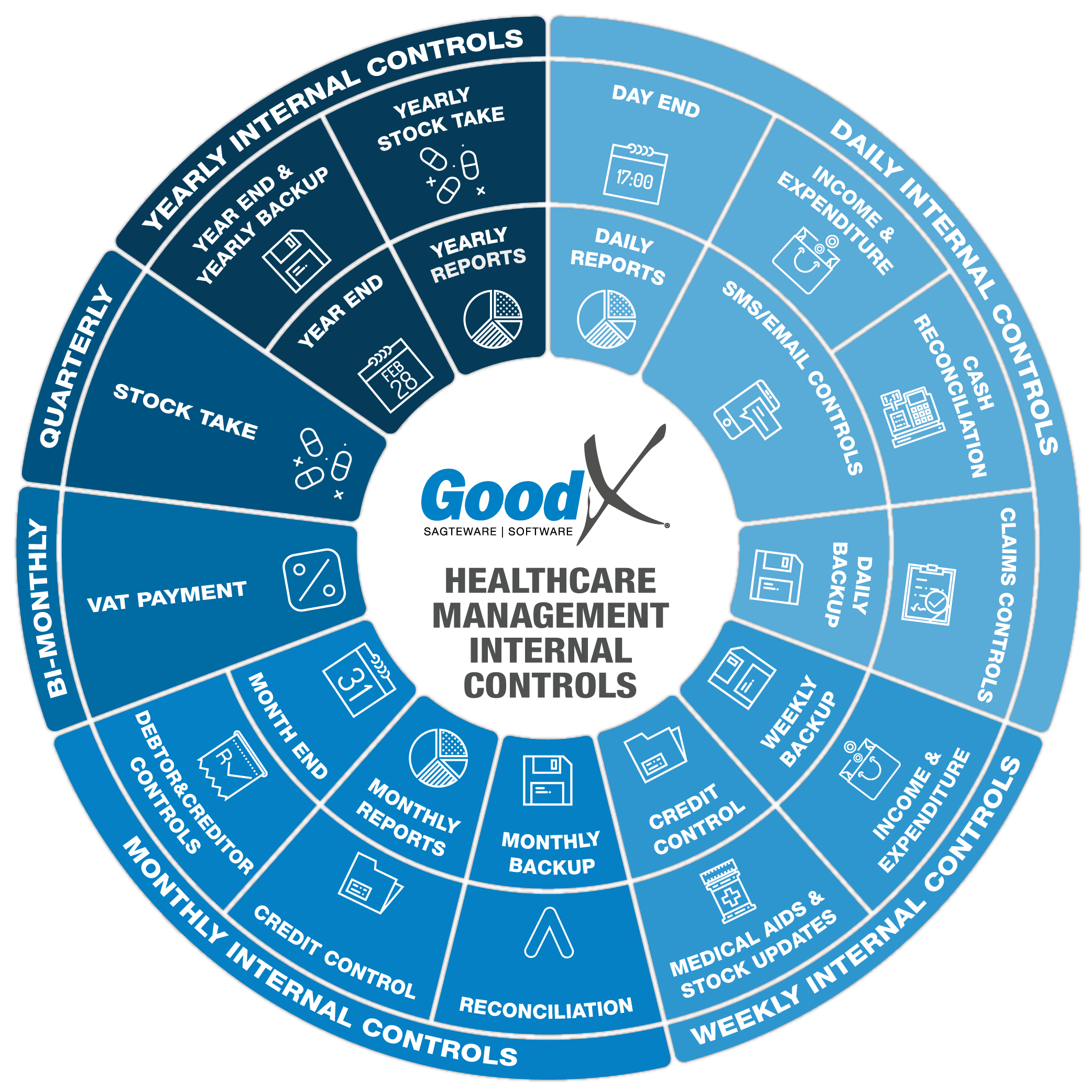

Best Practice Guidelines: Healthcare Management Internal Controls

Best Practice Guidelines: Healthcare Management Internal Controls

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

2. Daily Internal Controls Summary

2.5. Daily Reports

The following reports will assist the practice manager to manage the practice on a daily basis:

1. Unlinked Receipt Report

Receipts will be posted unlinked on accounts when the invoices have not been done. As soon as the invoice is done the receipt must be linked to the invoice. This will prevent the transactions to be listed on the age analysis with a plus (invoice) and a minus (the unlinked receipt). The Invoice outstanding report will also not balance when the receipts are not linked to the invoice. An unlinked receipt will be corrected by using a Zero receipt.

The following information can be found on the Unlinked receipts report:

- Entity posted in

- Practice Name

- Financial Period

- Transaction date

- Debtor Number and File Number

- Debtor Surname

- Invoice number

- Turnover, Cashflow, Journals and Outstanding

2. Debtor Transaction Drilldown Report

The Debtor transaction Drilldown report also known as the Daybook report is one of the most useful reports of all. The report has a lot of different types of information and can be used for a lot of different scenarios. The report has nine different reports that can be used, only four of these reports will need to be checked on a daily basis.

The following daily reports can be generated from the Debtor Transaction Drilldown (Daybook) Report:

- Audit trail report

- Audit trail invoice detail report

- Summarised Code report

- Deposits report

a. Audit trail report

The Audit trail shows all the debtor transactions that were captured for a certain period. The details will be on the invoice level. The report can be used for fault finding and grouping information that you need to report on. The different columns in the report will be the same on all types of transactions but only the information applicable to that transaction will display in the column.

The following information will be found on the report:

- Transaction date, Capture date and Financial Year

- Batch number, Document number and Split number

- Ledger account

- Debtor Account number, File Number and Case Number

- Debtor Initials and Surname

- Credit note and Journal description

- Journal Actions

- Amount without VAT

- VAT amount

- Amount including VAT

- The user who posted the transaction

- The patient portion on the amount

- Treating Provider and Referring Provider

- Service Centre

- Billing Group and Price list collection

- The number of transactions per transaction type - Count

- Total amounts per transaction type and the big total for all the transactions added together.

b. Audit trail Invoice detail

The Audit trail shows all the debtor transactions that were captured for a certain period. The details will be on the item level. The report is a lot like the Audit trail detail but this report is on the items that were billed on all the accounts, with more information available on the invoice lines. The report can be used for fault finding, grouping information that you need to report on, or filtering on certain codes or certain stock items that were billed on the patients. The different columns in the report will be the same on all types of transactions but only the information applicable to that transaction will display in the column.

The following extra information will be found on the report:

- Patient ID

- Medical Aid and Medical Aid Number

- Code (Stock Code or Tariff Code)

- Description (Stock Description or Tariff Description)

- ICD10 Code

- The quantity that was billed - QTY

- VAT % that was charged on the line

- Cost of Sales

- Patient Name and Surname

- Nappi Code

- Default Billing group, Posting Billing group and Price list

- Modifier code

- Authorisation number

c. Summary per Billing Code report

The Code report can be used by the practitioner to see which procedures, treatments and consultations were performed. The Code report will show which items were used the most. The report can assist in making decisions on which treatments to keep on doing, or which treatments/procedures must be stopped because of the rand value of these treatments/procedures.

The following information can be viewed on the report:

- Code (tariff or Stock code)

- Description or Name

- Units billed

- Number of times billed

- Total Amount excluding VAT per code

- Total VAT amount per code

- Total Amount including VAT per code

- Unit price

- Total of all units billed for all codes

- Total amounts billed for all the codes (VAT exclusive, VAT, VAT inclusive)

d. Deposit report

The Deposit report indicates all the receipts that were captured on the system as grouped by the different types of payment methods and all the Receipt corrections - Receipts written back.

The report can be used for fault finding and for reconciling the Cash, Card and EFT payments on a daily basis when the practice is not using the Cash register function.

The following information will be found on the report:

- Transaction date and Capture Date

- Deposit number

- Detail of the receipt or correction

- The user who posted the transaction

- Total that was received or written back

- Total per receipt type group together

The report can be printed at the end of the day. The cash in the cash bin must be counted and reconciled back to the cash section minus the cash corrections, and minus the float in the cash bin.

The card payments total on the report minus the card corrections must reconcile with the card slip that was printed at the end of the day at the card machine.

3. Turnover per provider (Practitioner)

The report can be used per day to indicate the turnover per practitioner in their GoodX diary. The settings and parameters are the same as the Debtor Statistics report. The report is a basic and quick report. The report will only show the practitioner that is logged in. The report is password protected.

This is a quick report that can be drawn to indicate the following information:

- Attending Practitioner

- Transaction date

- Visits

- Turnover, Cash Flow and Journals per practitioner

- Total Outstanding per Practice

4. Multi Invoice report

The Multi Invoice report will indicate the status on all the invoices that were captured through the Multi Invoice screen.

The report can be used to indicate all the invoices that were not yet posted, which invoices were only saved, invoices that were deleted or invoices in progress. The end result should be that all the invoices are posted.

The following information can be found on the report:

- Status of the invoice

- The user that was busy with the invoice

- Date created and last changed date

Filters that can be used:

- Busy

- Not Posted

- Posted

- Deleted

1. Unlinked Creditor Payment

Payments (Cheques) will be posted unlinked on an account when the invoice was not done yet. As soon as the invoice is done the payment must be linked to the invoice. This will prevent the transactions to be listed on the age analysis with a minus and a plus. An unlinked payment will be corrected by using a Zero cheque. This will also happen when the practice must pay a deposit for stock or services before the work can be done or before the stock can be delivered.

The following information can be found on the Unlinked receipts report:

- Entity posted in

- Practice Name

- Financial Period and Year

- Transaction date

- Creditor Number and File Number

- Creditor Name

- Invoice number

- Turnover, Cashflow, Journals and Outstanding

2. Creditor Transaction Drilldown Report

This report is used to generate the following daily reports for the Creditors:

- Audit trail report

- Audit trail invoice detail report

a. Audit trail report

The Audit trail shows all the creditor transactions that were captured for a certain period. The details will be on the invoice level. The report can be used for fault finding and grouping information that you need to report on. The different columns in the report will be the same on all types of transactions but only the information applicable to that transaction will display in the column.

The following information will be found on the report:

- Transaction date, Capture date and Financial Year

- Batch number, Source Doc number and Split number

- Ledger account

- Creditor Account number and File Number

- Creditor Name and Creditors Full Name

- Credit note and Journal description

- Journal Actions and Journal Account number

- Amount without VAT

- VAT amount

- Amount including VAT

- The user who posted the transaction

- Price list collection

- The number of the transactions per transaction type - Count

- Total amounts per transaction type and the big total for all the transactions added together.

b. Audit trail Invoice detail

The Audit trail shows all the creditor transactions that were captured for a certain period. The details will be on the item level. The report is a lot like the Audit trail detail but this report is on the items that were received or services that were rendered, on all the creditor accounts, with more information applicable to the lines. The report can be used for fault finding, grouping information that you need to report on, or filtering on certain codes or certain stock items. The different columns in the report will be the same on all types of transactions but only the information applicable to that transaction will display in the column.

The following extra information will be found on the report:

- Code

- Description (Stock Description or Service Description)

- The quantity that was received or credited - QTY

- VAT % that was charged on the line

- Price list and Price list collection

- Modifier code

1. Stock levels per warehouse (Stock re-order levels report)

Stock re-order quantity can be calculated from the maximum and minimum stock levels. The minimum and maximum quantity must be allocated to each stock item before this report can be generated.

The Stock re-order level report will indicate which items are less than the minimum required stock level and the report can be used to order stock items from the Suppliers. The report can also show which items are overstocked and, if possible, can be transferred to another branch.

The following report shows the following information:

- System code, Item Code and Nappi Code

- Item Description

- Pack size

- Warehouse Quantity

- Minimum Level and Maximum Level

- Reorder Quantity

2. Stock Movement per Detail

The Stock movement detail report will be used to see the complete Audit trail of the stock items. The Movement report can be drawn per single item, per a list of items, or for all the items that have movement.

The Movement report can be set up with columns and information as needed.

The report can also assist in Cycle counts on a daily basis.

If there are descriptions on the reports, please refer back to the glossary for the explanation if not mentioned in the stock guideline book in the GoodX Learning Centre.

The following detail will display on the report for each item depending on the report setup :

- Opening balance for the financial period, transaction date or capture date

- Closing balance for the financial period, transaction date or capture date

- System and Item code

- Type of transaction

- Document number (Invoice number - auto-generated in GoodX)

- Item description

- Transaction date, Capture date and Financial Period

- Cost per units

- Running total quantity and Value

- Case number applicable to Acute Hospitals, Sub-Acute Hospitals and Day Hospitals

- Financial Entity

- Bin where the movement took place

Purchases:

- Supplier whom the item was purchased from

- Supplier invoice number and Creditor or Supplier account number

- The user who has captured the Purchase / Supplier invoice

- Total Quantity that was bought and the total amount of the stock items bought excluding VAT.

- Additional Supplier (Applicable when Hospiformance or CJ Distributions are used for stock purchases)

- Supplier order number and Manufacturer of the Item

Sales:

- Patient and Debtor Name and Surname

- Debtor account number

- The user who did the billing on the patient's account

- The quantity that was given to the patient and billed to the patients account

- Item Cost of sales amount

- The amount of the stock items sold to the patient excluding VAT.

- Dispensing Doctor

- GP%

Transfers:

- Transfer Code and Transfer Description

- The user who did the transfer

- The quantity that was transferred from, or to the specified warehouse (minus if the Qty was transferred from, plus if the Qty was transferred to the warehouse)

- The value of the total quantity that was transferred

- The Unit value of the item that was transferred

Adjustments:

- Type of stock adjustment (Code and Description) and Ledger account

- The user who did the stock adjustment

- The quantity that was adjusted (Negative to make the stock less and a positive to make the quantity more)

- The value that was adjusted

Cashbook Report

The cashbook report is drawn per cashbook e.g. cash, card, and electronic. The cashbook report will indicate all the receipts that were captured for a certain period and per the receipt type. The report can indicate all the deposits and payments that were captured for certain dates.

The report can be used to check if all the receipts were captured for the day or if the corrections were done.

The following information can be found on the report:

- Opening and Closing Balance

- Description of the transaction type and Description of the transaction

- Batch Number and Document number

- Transaction and Capture date

- Recon code

- Amount excluding VAT, VAT and Amount including VAT

- The user who posted the transaction

- Running Total