Best Practice Guidelines: Healthcare Management Internal Controls

Best Practice Guidelines: Healthcare Management Internal Controls

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

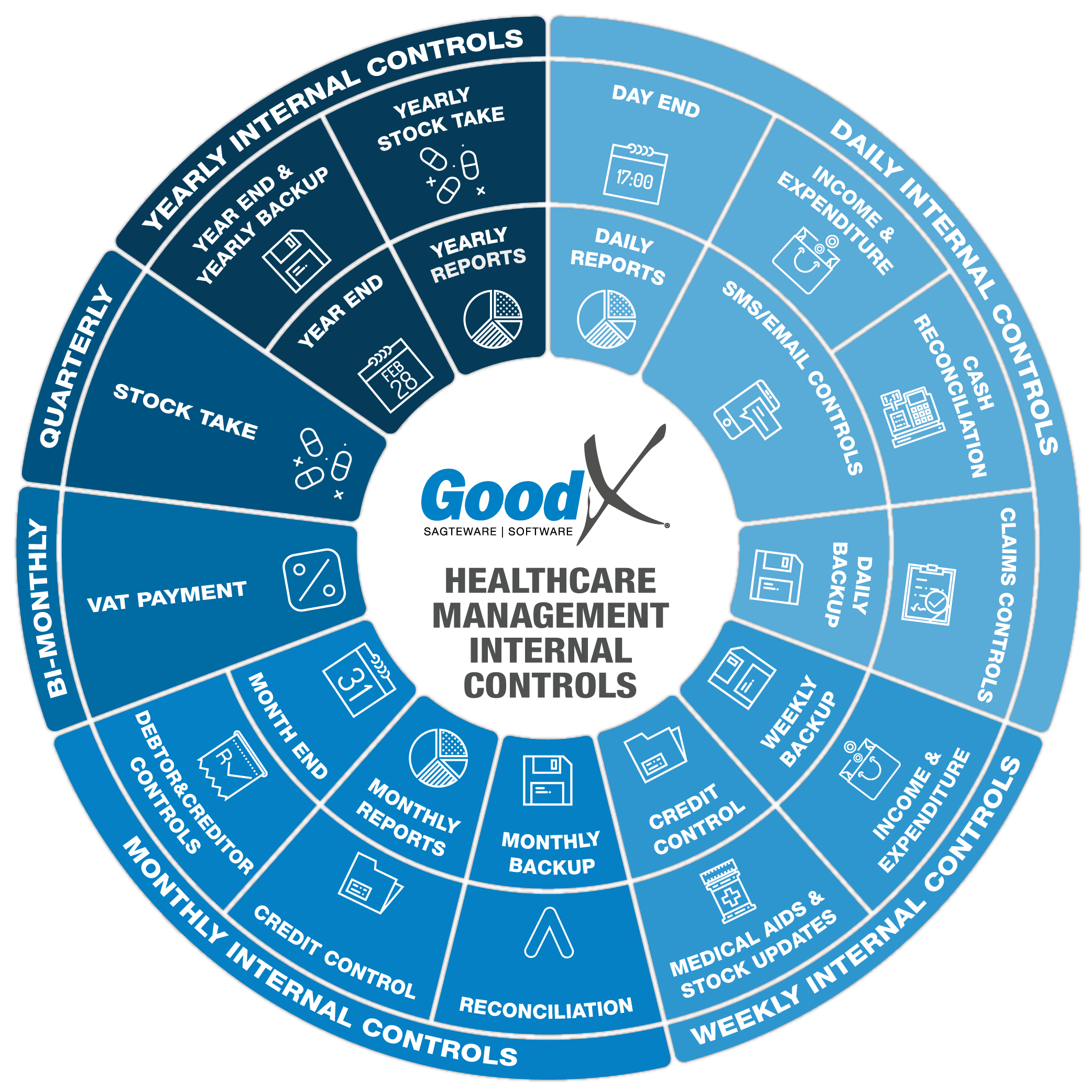

2. Daily Internal Controls Summary

2.2. Income & Expenditure

Income and expenditure controls check that the debtors, creditors, stock and accounting transactions are kept up to date daily.

If all transactions are kept up to date, the real financial status of the practice can be assessed daily on the system and fewer mistakes will escape the eye of the practice manager.

The following actions and report will assist in controlling the billing and receipting:

Debtors Transaction Drilldown report - Audit Trail

To confirm that all transactions have been posted for the day - invoices, receipts, credit notes and journals.

- Make sure that the report is grouped per Practitioner if the practice is working with multiple practitioners.

- Confirm that all consultations, procedures and stock were invoiced.

- Confirm that all ICD10 codes are correct.

- Check if the correct patients were invoiced.

- Confirm the VAT on the transactions, if the practice is registered for VAT.

- Look at all Credit Notes to check the reasons why they were posted and which user posted them.

- Confirm that all journals were done correctly with the right amounts, and posted to the correct ledger account(s) and the user who posted them.

- Reconcile all payments received in cash with the receipt book (if a manual receipt book is used).

- Count the cash and balance with the Cash deposit report under the Debtor Transaction drill down report.

- Reconcile all card payments with the summary receipt that the card machine prints out at the end of the day.

- Confirm that all EFT payments made by patients and medical aids reflect on the bank statement.

The following report and actions will assist in controlling invoices and payments:

Creditors drill down

Confirm all transactions posted for the day - invoices, cheques (payments), credit notes and journals.

- Confirm that all creditor expenses were captured for the day.

- Confirm that all transactions were posted to the correct ledger accounts.

- Check if the correct creditors were captured.

- Confirm if the correct VAT rate was used on the different creditors for the day.

- Look at the Credit Notes with the reasons why they were posted and the user who posted them.

- Confirm all journals were done correctly with the right amounts, posted to the correct ledger account and the user who posted it.

- Reconcile all payments (cheques) that were paid with petty cash to the creditors that were paid cash.

- Reconcile all the payments that were made by EFT with the bank statement.

- Reconcile all card payments that were made with the bank account.

- Confirm all admin fees and delivery fees have been captured.

Stock Movement per Detail

Confirm that all transactions have been posted for the day - supplier invoices, debtors billing, supplier credit notes (debit notes), debtor credit notes and stock adjustments.

Confirm the following on the purchases (suppliers) and debit notes:

- Confirm that all supplier invoices have been captured for the day.

- Confirm that the correct suppliers were used.

- Confirm that the correct VAT calculation was used.

- Confirm that the correct items and quantities were captured.

- Confirm that the total purchases balance back to the total supplier invoices.

- Double-check the items that were bought and captured into the system.

- Check which items must be returned.

- Check that all stock return debit notes have been captured on your system.

Confirm the following on the sales (debtors) and credit notes:

- Confirm that all patient billing has been done.

- Confirm that all stock used on the patients have been recorded on the system.

- Confirm that all non-chargeables have been recorded.

- Confirm that all corrections on debtors were done correctly with credit notes.

- Confirm that all credit notes have been posted.

- Confirm that all quantities that have been used have been captured.

- Confirm that the cost of sales has been calculated and is correct.

Confirm the following on transfers:

- Confirm that all transfers were captured.

- Confirm that all transfers were made to the correct warehouses.

- Confirm that the transfer in and transfer out columns match.

- Confirm that the printout was signed by the person who received the stock.

Confirm the following on the adjustments:

- Check the adjustment types/reasons that were used.

- Check that the users who did the stock adjustments are allowed to approve the adjustments.

- Check that the correct ledger accounts were used.

- Confirm the quantity.

- Confirm that the correct mathematical symbols were used. To increase stock, a positive amount should be posted. To decrease stock, a negative amount should be posted.

1. Bank statements (Imported into the main cash books and allocated to auxiliary cash books, ledger accounts and creditors)

Bank statements can be imported and allocated on a daily basis, depending on the number of transactions that are done on a daily basis. This function and check can also be done on a weekly basis. Once you have decided on a time frame for this check (e.g. daily/weekly), ensure that you consistently do this check accordingly. It is best practice to do this on a weekly basis except when there are more than 30 transactions in a week. The more transactions you work with at a time the more room for error exists, this also makes fault finding more complex.

- Check that all main cash books are up to date.

- Check if the imported bank statements are up to date.

- Check that all batches have been posted.

- Check for any allocation faults.

- Draw a ledger report per day to pick up any abnormalities.

- Check that the expenses have been posted as expenses.

- Check that the income has been posted as income.

2. Auxiliary Cash Books - Receipts (Debtors) and Payments (Creditors)

Auxiliary cashbooks are used for cash, card, and electronic receipts and payments. The receipts will be posted from the debtor account to the auxiliary cash book and the other side of the transaction will be posted from the bank account to the auxiliary cash book. The auxiliary cash books should always reconcile to a zero total.

- Ensure that all electronic receipts that have been received into the bank account, have been posted to the patient accounts.

- Ensure that all electronic payments that have been paid out of the bank account or credit cards have been posted to the creditor accounts.

3. Petty Cash

Petty cash is also explained in the cash reconciliation section of this book. Petty cash must be kept updated on a daily basis and reconciled.

The following petty cash checks are also important concerning income & expenditure:

- All expenditures must have valid till slips.

- All transactions must be recorded into the petty cash.

- Deposits into the petty cash must be recorded.

- Confirm that all expenditures are allocated to the correct expense ledger account.

- Confirm that all income has been allocated to the correct income ledger or auxiliary cash book account.