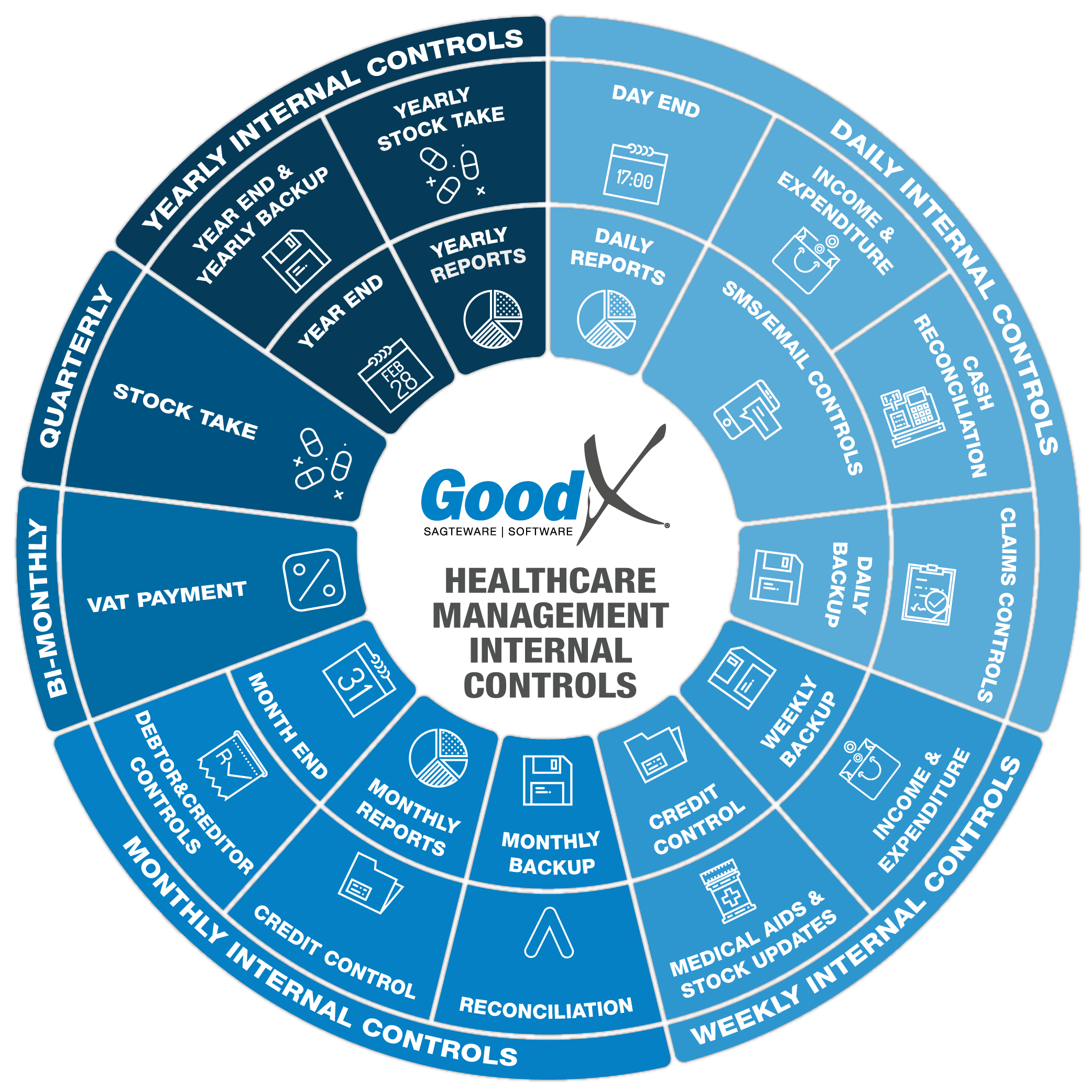

Best Practice Guidelines: Healthcare Management Internal Controls

Best Practice Guidelines: Healthcare Management Internal Controls

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

3. Weekly Internal Controls Summary

3.3. Credit Control

Short payments from medical aids and outstanding accounts from private patients result in unpaid debt that needs to be strictly managed and collected. If there is no proper debt collection, it could result in debt that has to be written off, negatively impacting the finances and cash flow of the practice.

1. Medical Aid Outstanding Accounts

Medical aids make payments to practices through payment runs and the time spans between claims and payments differ from medical aid to medical aid. Most of the bigger medical aids have payment runs once every two weeks and smaller medical aids have monthly payment runs. The practice will do well to send claims as soon as possible so that they can form part of the next payment run of the medical aid.

a. Telephonic communication

When payment for a claim is not received with the expected payment run, the medical aid can be phoned:

- Enquire if the medical aid received the claim.

- If the medical Aid received the claim, when can you expect payment and what is the reason for the delay in payment?

- If the medical aid did not receive the claim, the proof of submission can be sent to the medical aid or the claim can be resubmitted. Be careful that a resubmission will not end up in a duplicate claim.

- Make sure to inquire about all the patients from the same medical aid during one call.

- Ask for a reference number for the call.

- Make notes of the call in the Notebook and include the reference number of all the outstanding patients that were included in that call.

b. Email communication

Emails can be used to follow up on claims with the medical aids on outstanding accounts and the proof of submission can be attached.

Make sure that the email address is correct and follow up on the emails that were sent to the medical aids.

2. Private Patient Outstanding Accounts

Private patients are patients that do not have medical aid or when the patients' medical aid does not cover the account or have short payments on the claims. The practice must have certain policies in place with private patients. A good practice is to let the patient pay cash or card before the patient leaves the practice, or pay in advance if possible.

a. Telephonic communication

If a patient has an overdue account, it is wise to telephonically contact the patient and discuss the following:

- Ensure that the patient knows about the outstanding balance.

- Ensure the patient knows of the short payment and the reason for the short payment.

- Phone the patient and try to get a commitment for payment of the outstanding amount.

- Make a note in the notebook of the conversation and record the commitment made by the patient.

- If the phone call is recorded, save the recording somewhere for future reference.

- Phone the patient a day after the commitment date if the payment was not received.

b. Email communication

Emails can be used to follow up on outstanding patient accounts and statements must be attached to the email.

Make sure that the email address is correct and follow up on emails that were sent to patients.

If the email was sent from GoodX, an automatic note will be added to the notebook.

c. SMS communication

An SMS is an electronic message to a cellphone number. The SMSes always have limited characters that can be used in one SMS. SMS pre-setup templates can be used when using the SMS function. Batch SMSes can also be sent to all outstanding accounts.

3. Debtor Statuses

When a patient has a commitment, send out an SMS to the patient a day before the commitment due date and remind the patient about their commitment.

A patient can reply on an SMS, please check the SMS history for any queries and arrangements.

For each SMS sent to a patient, an entry will be made in the patient’s notebook.

A debtor status can be assigned to each account. Debtor statuses can assist staff in following a specific protocol according to the status of the account. Accounts that have a status linked to them must be kept up to date. When the status changes the system must be updated. The following can be used as examples for different statuses:

- Bad payer

- Do not assist

- Cash only

- Pay off arrangements

4. The Notebook

All patients have an electronic notebook on GoodX. The notebook can be utilised for:

- Documenting payment arrangements with patients.

- Proof of communication with patients.

- Proof of communication with Medical Aids.

- Having an audit trail of communication that can be used when handing over outstanding accounts for formal debt collection.

The notebook can be printed or emailed.

5. Age Analysis Report

The Age Analysis only displays the outstanding accounts and the account that is in credit. The Zero accounts will also be displayed on the full age analysis and can be filtered out. The Zero accounts are the accounts that have nothing outstanding.

An Age Analysis is divided into the following:

- Total outstanding amount

- Medical Aid Outstanding

- Private Patient Outstanding

- Current Outstanding

- 30 Days outstanding

- 60 Days outstanding

- 90 Days outstanding

- 120 Days outstanding

- 150 Days outstanding

- 180 + Days outstanding

a. Outstanding Accounts

It is preferable that no accounts are more than 60 days in arrears. The longer debt is outstanding, the less chance there is of recovery of the debt.

Use the debtor age analysis to identify accounts that must be flagged for collection. Design a collection process for the practice, eg that the first week of the month will be a time to follow up on all the 30-day outstanding accounts, the second week of the month to follow up on all the 60-day overdue accounts etc.

Remember to make notes in the notebook with all actions being taken and conversations.

b. Credit Accounts

Credit amounts on the Age Analysis should be investigated to understand why there are credits on those accounts. Credits can be the result of:

- Receipts that were allocated to the wrong debtor accounts - these should be corrected so that receipts are posted to the correct debtor accounts and linked properly to their corresponding invoices.

- Receipts that are not linked to their invoices - receipts should be linked to their corresponding invoices to clear the account.

- Payments made by patients and their medical aids, being a double payment on the account - should be refunded to the patient.

- Wrong payments made by medical aids - the credit must be kept until the medical aid reverses the amount on the following remittance.

6. Credit Control Assistant (CCA)

The Credit Control Assistant (CCA) is a function in GoodX that assists the practice to follow a collection process on overdue accounts. The process will be set up by the practice and it will guide the credit controller through the different debt collection cycles. The Credit Control Assistant cycles can be set up according to the practice's needs.

a. Business Process Design

Before a practice or bureau can do the setup of the Credit Control Assistant, the business processes need to be designed.

Determine the following:

- Which steps do you want to take in the collection process?

- Do you want to calculate your collection cycles from the service date or capture date?

- Determine the number of days from the service or capture date associated with each process.

- Decide which SMSes, emails, front pages and final demands you want to use with each step and set it up.

The following serves as an example of steps taken after service or capture date:

- within 5 days - send out an invoice.

- 14 days - send out a statement.

- 21 days - send SMS to the patient.

- 45 days - final warning.

- 60 days - handover/write-off.

Depending on the Creditor’s agreement with the practice, there will be different checks on the accounts. When the account is in credit at a creditor, the creditor is owing the practice money. This can be claimed as a refund or allocated to future services or purchases.

Creditors can be divided into the following categories:

- Pay before delivery

- Pay immediately after delivery

- 30-day accounts

- 60+ day accounts

Credit Control on creditors will include the following information:

- Check if all suppliers who must be paid immediately after delivery have been paid and captured on the system.

- Ensure all credit accounts at the creditors are managed correctly

- Ensure that when a creditor has been paid too much that the amount is paid back or kept on the account and allocated to outstanding invoices in the future.