Best Practice Guidelines: Stock Management 28/06/2024 (In development)

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

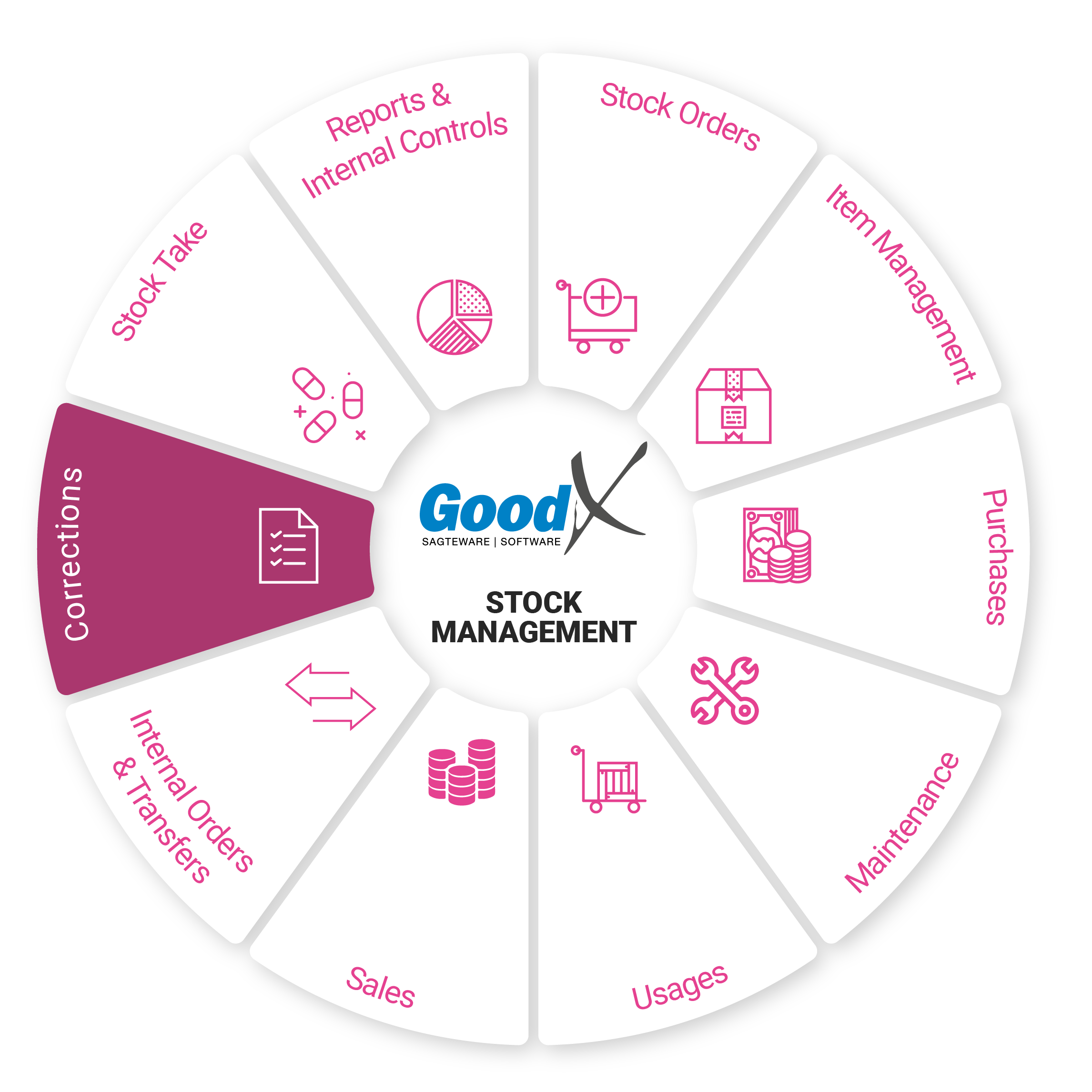

10. Summary: Corrections (Flowchart)

10.1. Corrections

Responsible Roles

|

Practitioner: When Stock items break while used on patients, the practitioner must communicate with the Stock Controller to make adjustments on the system and ensure the correct disposal of items and a correct cleaning process when there is a chemical spill. |

|---|---|

|

|

Stock Clerk: Check for expired or broken stock. Take stock items to the stock controller to do adjustments on the system and dispose of items through the correct procedures. |

|

|

Stock Controller: Do Stock adjustments on the system for Broken, Expired and Lost Stock items. Ensure the correct procedures have been followed to dispose of items. Double-check the adjustments at the end of the week to ensure all the corrections have been

explained and investigated. |

|

Financial Manager: Sign off all corrections that were done. Capture Credit Notes that were received from suppliers for stock that was sent back or incorrectly invoiced. Ensure all Credit notes were received from suppliers as soon as possible. Correct any incorrect

capturing of supplier invoices on the system by the Creditors Clerk by creating Credit notes. |

Critical Steps of Corrections

Critical Steps of Corrections

There are 2 different types of corrections - Credit Notes and Stock Adjustments. The correct type of correction must be used. Ensure that corrections can only be done by users who are permitted to do so.

Credit Notes

A Credit Note will be used for the following reasons :

- When the Supplier invoice was captured incorrectly into your system

- When items are sent back to the supplier

- When the incorrect items were received

- When the Qty or Price is incorrect

Credit Notes are a legal document that you must keep for auditing purposes. For the Practice, this will be a Debit Note in the financial language.

A credit note will reduce the stock levels in the warehouse where the Supplier invoice was originally captured. If there was a transfer with this quantity, the units must first be transferred back to the correct warehouse before the Credit note can be done.

Stock Adjustments

Stock Adjustments will only be used for the following 3 reasons:

- Broken Stock

- Expired stock

- Lost Stock

When working with lost stock, please check that all billing and purchases are up to date and correctly captured.

At Stock take a preset stock adjustment will be used to post the stock take variance.

Pre-setup stock adjustments will be set during installation, linked to the correct Expense Ledger account. If the practice needs more types of adjustments, new ones can be created.

When capturing the adjustments, double-check the warehouse where the stock must be deducted.

If the stock item must be reduced a minus must be put in front of the quantity.

Re-evaluate the Stock Value

The value of the items can be calculated incorrectly when there are data problems on your databases. This will be an ongoing problem when working with minus stock levels. The system does not know which value to use for the stock that goes into a minus stock level, because according to the system the practice does not have any units of the stock item.

If the item price has a high increase or decrease in price the value can also be incorrect. The system calculated the value with the last 5 years transactions, depending on the set up of the practice.

In certain cases, the units will be zero but still, have a value that must be corrected with a re-evaluate. This will happen when the item prices have big differences, the weighted average must be corrected. The Force Zero Value if Qty zero function will show all the items that have a value but with no quantities, and will adjust the value when this is posted.

The re-evaluation will be done with a stock adjustment using the Stock Adjustment List function. The function has a build in re-evaluation with Last Purchase price, Unit price or List Price and at hospitals to NAP price.

When mistakes were made in the system and not rectified with the correct transactions, the stock value will need to be reset. This is not an everyday function that can be used and should only be used at the last resort. GoodX can be contacted to assist in this process. The weighted average will be reset and re-calculated according to the Last purchase price, unit price or list price and at hospitals to NAP price.

Functions that will be used in GoodX

- Stock Credit note New interface (Purchases > Stock Credit Note)

- Stock Adjustment Single (Corrections > Stock Adjustment Single)

- Stock Adjustment List (Corrections > Stock Adjustment List)

- Stock Adjustment codes (Stock Setup > Stock Adjustment codes)

- Force value zero if Qty Zero (Corrections > Force value zero if Qty Zero)