Best Practice Guidelines: Healthcare Management Internal Controls

Best Practice Guidelines: Healthcare Management Internal Controls

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

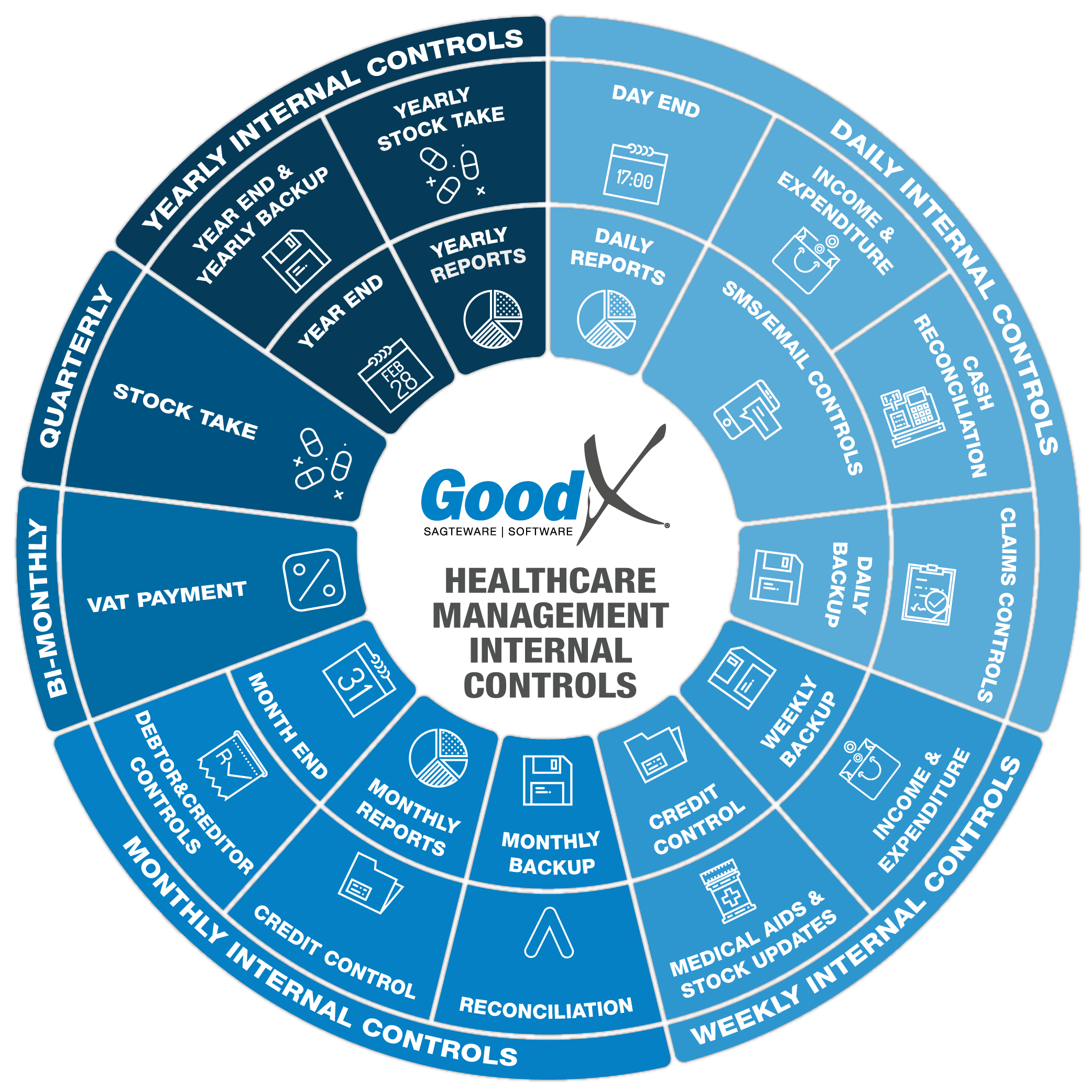

7. Yearly Internal Controls Summary

7.3. Year End

The following transactions need to be posted and checks must be done before year end:

- Depreciation on all assets.

- Ensure the Asset register is correct and up to date.

- Payroll must be done for the year.

- Financial Leases need to be posted.

- Budgets must be reconciled with the yearly reports.

Year end is a function to close the previous financial year, to prevent any changes in the reports. A financial year is a 12-month period that is combined into a financial year.

Each practice is registered at SARS where you will receive a date when the practice's financial year will end. A lot of practices year-end are at the end of February each year.

It is important that the year-end is done before the new year transaction is posted, otherwise, the transactions will post into the first open financial year.

The following should be checked with the year-end function:

- Make sure all transactions are up to date.

- make a certain person responsible to do the year-end every year, and have a second person that is on standby if the first person is not available.

- Make a backup before the year-end is run.

- Run the year-end

- Use the year-end log report to check if the year-end was done successfully.

- Draw the yearly reports.

The year end function will take the income total for the year minus the expenditure total, it will move the difference between the income and expenditure to the profit/loss ledger account for the next financial year.

The income and expenditure ledger accounts will start on a zero amount in the next financial year.

The Budget can be discussed for the next financial year.