Best Practice Guidelines: Healthcare Management Internal Controls

Best Practice Guidelines: Healthcare Management Internal Controls

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

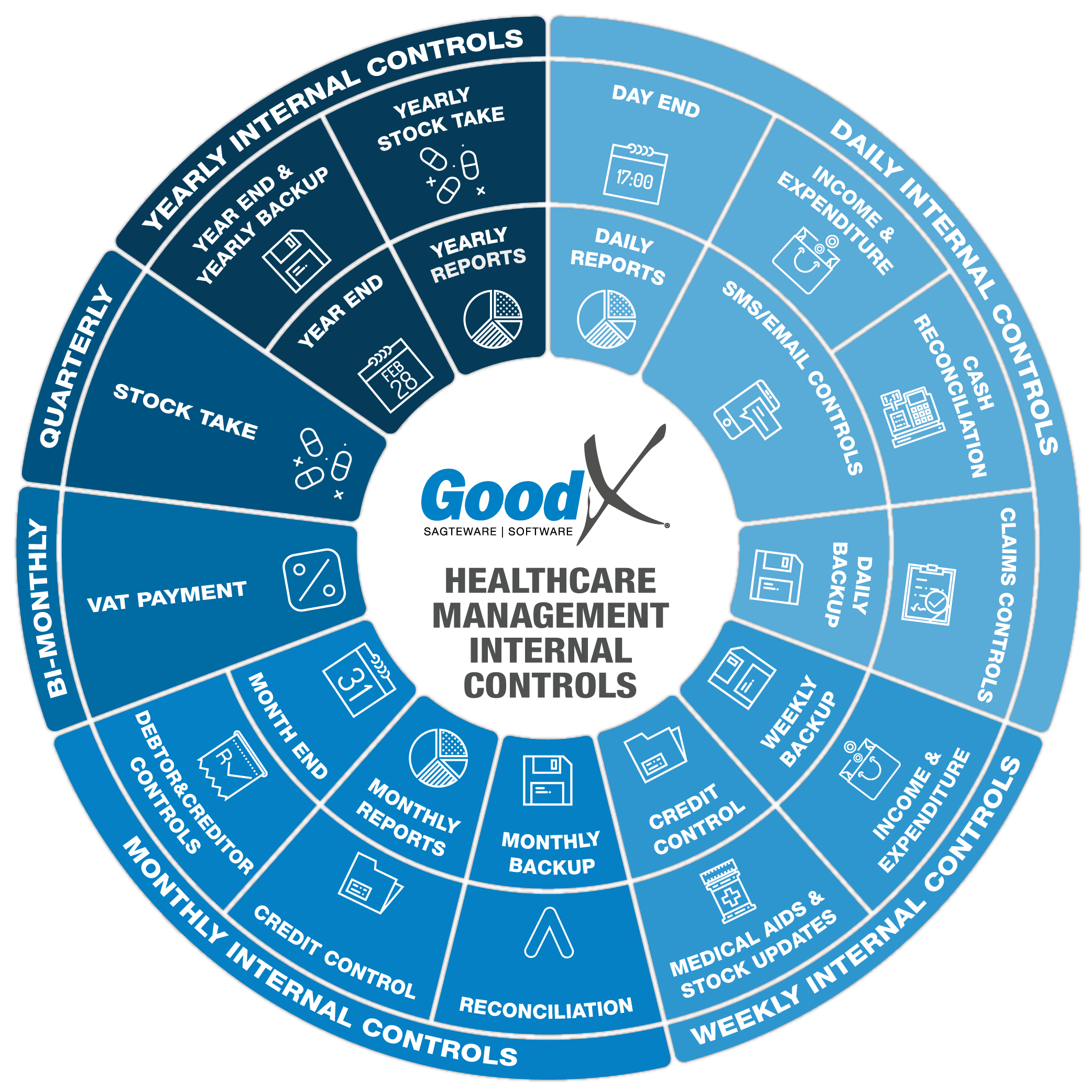

3. Weekly Internal Controls Summary

3.1. Income & Expenditure controls

Income and Expenditure controls check that the Debtors, Creditors, Stock and Accounting processes are completed weekly.

The following actions and reports will assist in controlling the billing and receipting:

1. Invoices

a. Invoice outstanding

Invoices outstanding are all the invoices that were not yet paid by the medical aid or by the patient. The outstanding invoices must be followed up and will be part of the credit control process.

A report can be generated for all the outstanding invoices and you can make sure that this is part of the credit control process.

b. Payment Plan

A payment plan is used by orthodontists to enable private patients and medical aid patients to receive orthodontic procedures and pay off the fees relating to the procedures. The payment plan allows users to generate quotes for treatments for the patient. The quoted amounts are divided into multiple invoices to be paid monthly over a period of time. Reports are generated monthly to calculate the amounts patients must pay every month for the treatment of orthodontic procedures and how many payments there are left.

The report must be checked weekly to ensure the correct amount will be invoiced to the patient at the end of the month or whenever the payment plan function is run.

c. Episode Management

The episode management function is important for bureaus that bill on behalf of practitioners and who receive information on treatments on a weekly or monthly basis from practitioners to be billed. The episode numbers will be allocated beforehand and then invoiced after receiving treatment information. The report can be drawn to make sure that all episode numbers that were allocated were received from the practitioners and used for the correct patients.

Make sure that all the episode numbers that were allocated to a medical practitioner have been received back from the medical practitioner and invoiced.

d. Electronic Data Interchange (EDI) response

Electronic Data Interchange (EDI) is the real-time electronic interchange of claims information via GoodX switch between healthcare practitioners and medical aids or their administrators. No paper claims or email claims need to be sent and it reduces the amount of manual work at the medical aids or their administrators. Most of the time, responses are received back from the medical aid or their administrator before the patient leaves the practice, which provides the opportunity for the practice to collect outstanding fees and expenses immediately after the consultation or procedure.

EDI responses must be checked on a daily basis and must also be checked on a weekly basis for claims that have not been resolved the same day they were sent. If there were any errors with the data that was sent, corrections need to be made as soon as possible and the claims must be resubmitted.

Some EDI responses take longer to come back than others, so make sure that all delayed responses were received and resolved.

This control is also discussed under Claims Controls in Daily Controls in more detail.

2. Receipting

a. Unlinked Receipts Report

Unlinked Receipts will occur when a receipt is not linked to an invoice at the time of capture. This should only happen when a patient pays before the consultation and before the invoice is generated. When the invoice is created, the receipt must be linked to the invoice to create a zero balance on the account. Unlinked receipts will show on statements as unlinked receipts and the invoices will show as outstanding.

The Unlinked Receipt report can be used to view all the receipts that are still unlinked on all debtor accounts and after generating the report, all unlinked receipts must be linked to their corresponding invoices.

b. Refunds to patients

There are two main reasons why patient accounts are in credit:

- The patient has paid a deposit for future work to be done by the practitioner;

- The patient has paid for services and thereafter the medical aid pays for the same services.

If a patient's account is in credit due to a double payment for the same services, the credit must be refunded to the patient. Refunds can be done on a daily basis but must be checked on a weekly basis.

c. Electronic remittance advice (ERAs)

Any payment by a medical aid or their administrator to a healthcare practice must be accompanied by a payment schedule called a remittance advice that indicates for which patients and for which services the payments are processed. Practices can register with GoodX to receive remittance advices electronically. GoodX will allow the user to import these ERAs into GoodX and the data will be matched so that manual intervention is limited as far as possible. The results are that staff save time because they do not have to create manual receipts for every patient on the remittance advice.

ERAs can be posted daily, but they should only be posted into the software as receipts once it has been established that the money has been received into the bank account of the practice.

The practice manager should check weekly if all ERA money was received into the bank account and if all such ERAs were posted successfully.

Creditors and Supplier Controls

The following must be checked on a weekly basis:

- If all credit notes as received from the suppliers for stock returned back to the supplier have been captured as a debit note on GoodX. (On GoodX these debit notes from your suppliers will be captured with credit notes.)

- If all payments to your creditors (Cheques) have been captured and checked on GoodX the creditor account on GoodX will balance with the actual monthly account/statement as received from your creditor.

If all the transactions of the Debtors and Suppliers are correct and up to date and properly checked by the Debtors and Creditors' internal controls, all the stock transactions will be up to date and correct.

The following transactions must be checked weekly with the Stock control process:

- Expired stock

- Broken stock

- Lost stock

- Stock transferred between Warehouses.

- Returned stock

- Follow up on backorders and cancel if necessary.

Stock Movement report: Detail

- Confirm under the Sales that the units are correct.

- Confirm with the sales that the correct items were charged to the patients.

- Confirm that the correct items were captured under purchases.

- Confirm that the correct units were captured with the purchases.

- Confirm that the credit notes (sales and purchases) were approved and who the user was who did the credit notes.

- Confirm that the Stock adjustments that were made were approved and correctly captured with the correct units.

- Confirm that all transfers between warehouses are up to date and that the correct units were used.

If all the transactions of the Debtors and Creditors are correct and up to date and properly checked by the Debtors and Creditors' internal controls, it follows that most of the accounting transactions will be up to date and correct.

In the accounting module, there are not a lot of extra weekly invoices and receipts to be done because most transactions are Debtors and Creditors transactions. E.g. Business expenses will have to be added.

The following actions and reports can assist in making sure the accounting is up to date:

- Importing of bank statements - removes human errors from creeping into transactions.

- Allocation to the correct expenditure or income ledger accounts.

- Allocate payments to the correct creditors to ensure the creditors' controls are up to date.

- Allocate receipts to the debtors accounts to ensure the debtors controls are up to date.

- Reconciliation of Main Cash Books and Auxiliary Cash Books.