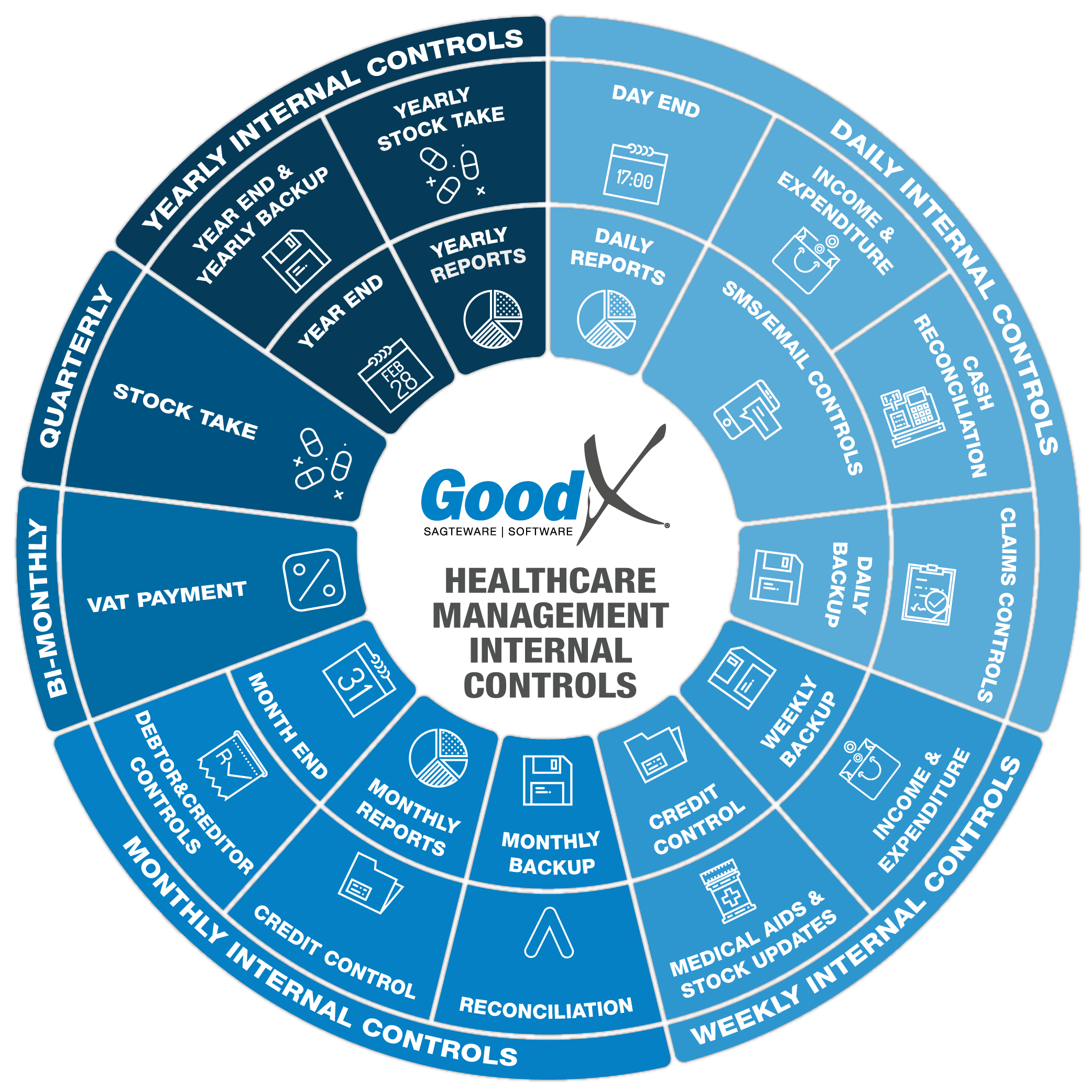

Best Practice Guidelines: Healthcare Management Internal Controls

Best Practice Guidelines: Healthcare Management Internal Controls

Copyright © 2020 GoodX Software. All rights reserved.

GoodX online Learning Centre

learning.goodx.co.za

2. Daily Internal Controls Summary

2.1. Day End

At the end of every day, the practice manager needs to make sure all the daily tasks have been completed. The daily tasks will be divided into Debtors, Creditors, Stock and Accounting.

1. Close all cash register sessions

All cash register sessions must be closed so that they can be reconciled (See under Cash Reconciliation).

If the cash register sessions are not closed, the cash reconciliation cannot be done. If sessions are not closed, the risk for the practice is that different users will work in one cash register session and if there is a cash deficit, it cannot be established who is responsible for the deficit.

As soon as the cash register session is closed, the reconciliation can be finalised to make sure there is no deficit.

2. Finalising, posting and switching batches/saved invoices

Invoices that were created and saved but not posted (Desktop App and Web App) must be checked, finalised, posted and switched.

Desktop App batches

If the practice uses the Comprehensive invoice screen and wants to batch invoices, first to be checked and posted later, the list of comprehensive batches that were created must be checked to make sure all have been posted successfully. If the invoices are not posted and switched, they may be forgotten and claims may become stale.

Desktop App saved invoices

Saved invoices should be checked by generating the Multi invoice report and thereafter posted and switched. If the invoices are not posted and switched, they may be forgotten and claims may become stale.

Web App saved invoices

Check the diary at the end of the day to see if the invoice icons next to each booking are all green, meaning they have been posted and switched. Invoices that appear blue are only saved, which means that those invoices are only temporary and are indicated with a TM at the front of the temporary invoice number. They should all be finalised.

3. Non-invoiced bookings

All bookings must be checked to see if all were invoiced.

Desktop App bookings not billed

Use the Print day's list of invoices report to see which bookings were not invoiced (Diary only).

- Confirm if the "Number of Visits" and "Number of Invoices" with their totals reconcile with each other.

- Check your "Transaction Detail Column" and confirm the invoices, receipts or journals per booking.

- Check to see why there might be No Charges.

- Look for Walk-outs (Patients who did not pay for treatment).

Web App bookings not billed

Every booking's invoice icon that appears grey means that no invoice has been generated for the consultation and the icon will turn blue when the invoice was saved but not posted.

All invoices for the daily bookings need to be completed, posted and switched so that all booking invoice icons turn red.

Once a receipt has been issued for payment, the icon will change to green.

The following actions will assist in controlling the receiving and invoice-capturing process:

Creditor/Supplier invoices must be checked for any mistakes. The incorrect information must be sent to the creditor or supplier to be corrected immediately. For example:

- Incorrect practice details.

- Incorrect items on the invoice.

- Incorrect amount.

- Incorrect quantity.

After the hard copy has been checked and all the information is correct, the invoices must be captured on an electronic system. The system should always be a replica of the hard copies.

The following information must be checked on a daily basis:

- Confirm all creditor invoices have been received and captured on the system.

- Supplier invoices must be up to date.

- All creditor/supplier demographic information must be updated.

- All debit notes must be posted.

1. Item Management

Item management is an ongoing, day-to-day process. The stock clerk and stock controller will need to take responsibility for item management.

The following item management functions need to be managed daily:

a. Activating and deactivating stock items

The stock list is received from MedPrax and kept up to date by MedPrax. All the items will be uploaded as inactive items. All items will be on the list but inactive items will not be available to be used, billed or purchased.

- Check that the items on the active list are correct and accurate.

- Ensure that the responsible personnel know how to indicate the correct items and mark the items as active, according to the Nappi code.

- Ensure that when an item is changed to active that all the necessary documentation is updated. For example, billing sheets and barcodes.

b. Discontinued stock

A Practice will be informed when an item is discontinued by either the suppliers or MedPrax. The practice should have a policy for how to handle discontinued stock items.

Practices can send items back to the supplier that is still in stock or uses the items and transfer the items to the new Nappi Code.

- Ensure that all items that are sent back to suppliers are packed and marked correctly.

- Ensure that the pickup company collects all discontinued stock.

c. Item linking

Item linking will indicate where an item must be in the practice.

- Spot checks should be done daily to ensure that the correct items are linked to the correct locations in the practice.

- Ensure all personnel know when items are moved in the practice to ensure that the correct process is followed.

- Any new item must immediately be linked to the correct counting location.

- Ensure that the process is followed and checked.

d. Subclasses and cycle counts

Each item can be linked to a subclass. Subclasses can be used to do cycle counts every day.

- Make a schedule to ensure all subclasses are counted at least once a month.

- Check the variance on the cycle count and investigate the variance.

- After investigating a variance, a new process should be put in place to eliminate the reason for the variance.

e. Negative stock levels

Stock levels that are indicated with a minus sign in front of the quantity are negative. That means items were used or sold that the practice did not have.

- Draw a stock-on-hand report every day.

- Investigate the negative stock levels.

- Put processes in place so that negative stock levels are avoided.

- When negative stock levels cannot be avoided for some items, ensure that the items are set up correctly and the correct process is in place to manage the items.

2. Stock Orders and Receiving Stock

The practice needs to decide on the frequency of stock orders. Depending on the practice’s policy, the controls will be implemented daily, weekly or monthly.

a. Stock orders

It is important to do stock orders correctly. Incorrect orders can cause big financial losses or put the practice at risk of not being able to treat patients.

- Check the minimum stock levels on a daily basis.

- Check the maximum stock levels before approving an order.

- Backorders must be checked before new stock is ordered.

- Check the items that are ordered for any abnormalities, for example, the strength or size of the items.

- Check the pack size of each item ordered.

- Ensure that all stock orders have been approved.

- Ensure that the "paid before delivery" suppliers are paid on time.

- Ensure that the budget has not been exhausted and is managed correctly with each order.

b. Receiving stock

When receiving stock it is important to ensure that the stock that you are receiving is the correct stock and that it is in good condition.

- Ensure that the person/s receiving the stock has the knowledge to check the items on delivery.

- On delivery check the expiry date, quantity, size, strength and condition of all items received.

- Check whether all the stock items on the invoice have been received.

- Ensure that all items received are kept in a safe place until the items can be placed in their correct locations.

Barcodes

When a practice makes use of barcodes, the following has to be checked:

- Ensure that all items have barcodes on them, before placing them in their assigned locations.

- Ensure that each item’s barcode is correct, according to its pack size and Nappi code.

3. Transfers

Practices with multiple warehouses must do transfers immediately after moving stock from one warehouse to another. This will ensure that stock levels are always accurate in all warehouses, and that stock can be billed from the correct service centres.

- Check transfer requests for abnormalities.

- Check that the transfer receipt printout has been signed by the correct receiver.

- Ensure that all unused stock is transferred back to the main warehouse on a regular basis before expiring.

- Check that all transfers for the day have been captured.

4. Broken Stock (Stock Adjustment)

Broken stock items are items that have been broken on the premises of the practice by the personnel of the practice. Broken stock does not include items that were received broken from suppliers. Broken stock must immediately be adjusted on the system and discarded using the correct method. All regulations must be adhered to as required by the health department.

- Check that all broken stock has been reported.

- Check that all broken stock adjustments have been recorded on the system.

- Check that the correct process has been followed to discard the broken stock.

1. Assets and The Asset Register

Assets must be recorded on the asset register as soon as possible after the asset has been purchased.

- Ensure that all assets have been recorded on the asset register.

- Check that all details are accurate.

- Check that the purchase date is accurate, to ensure that depreciation calculations are done correctly.

- Check that assets are classified correctly, to ensure that depreciation calculations are done correctly, for example as vehicles or equipment.

- Check that the hard copy invoice has been filed in a safe place.

2. Reconciliation

Reconciliations (recons) are very important. The recons will show errors that need to be amended. When a recon is successful, the practice knows everything is accurate and up to date.

- Reconciliations must be done and checked on a daily basis.

- The following reconciliations must be done:

- Cash register (refer to the daily cash reconciliation)

- Petty cash (refer to the daily cash reconciliation)

- Main cashbooks (refer to monthly reconciliation)

- Auxiliary cashbooks (refer to monthly reconciliation)

- Main cash books must balance back to the actual closing balance on the bank statements.

- Auxiliary cash books must balance back to zero.

- Any unreconciled information must be reconciled immediately.

- Ensure that all reconciliations that have failed, are checked and that it is understood why each reconciliation failed.

3. Documentation

Keeping proper records is crucial. Auditors will need hard copies of all financial transactions.

All information captured on the system must be replicas of the physical documents. The auditors will compare the system to the hard copies to verify the information during their yearly audit.

- The electronic and hard copy documentation must be saved in a safe place.

- Backups must be made of this documentation as well.

- Ensure that all contracts are up to date and still valid.

- Ensure that important documents are not lying around for everyone to see.